“Stand up, be bold, be strong. Take the whole responsibility on your own shoulders, and know that you are the creator of your own destiny.” Swami Vivekanandaji

School

of Tally

(Simplified Business Solutions)

(Hare Krishna)

|

Course No. |

Course Title |

Page |

|

Tally.100 |

How to run tally in Educational Mode |

4 |

|

Tally.101 |

Creation of Company &Statutory Setting of GST |

5-7 |

|

Tally.102 |

Leger Account Creation |

8-9 |

|

Tally.103 |

Unit of Measure Creation |

10-11 |

|

Tally.104 |

Stock Item Creation |

12-14 |

|

Tally.105 |

Voucher Creation |

15 |

|

Tally.106 |

Contra Voucher Creation |

16-19 |

|

Tally.107 |

Payment Voucher Creation |

20-22 |

|

Tally.108 |

Receipt Voucher Creation |

23-24 |

|

Tally.109 |

Journal Voucher Creation |

25-29 |

|

Tally.110 |

Sale Bill Preparation |

30-41 |

|

Tally.111 |

Purchase Bill Entry |

42-44 |

|

Tally.112 |

How to see all the entries |

45 |

|

Tally.113 |

How to repeat narration in tally voucher |

46 |

|

Tally.114 |

How to copy narration in tally voucher |

47 |

|

Tally.115 |

How to see Ledger Balance |

48 |

|

Tally.116 |

Purchase Voucher Type Creation |

Pending |

|

Tally.117 |

Sale Voucher Type Creation |

Pending |

|

Tally.118A |

Direct Expenses List |

49 |

|

Tally.118B |

Indirect Expenses List |

49-52 |

|

Tally.119 |

Practice Tally Study-1 |

53 |

|

Tally.120 |

Practice Tally Study-2 |

54 |

|

Tally.121 |

Practice Tally Study-3 |

55 |

|

Tally.122 |

Practice Tally Study-4 |

56 |

|

Tally.123 |

Practice Tally Study-5 |

57 |

|

Tally.124 |

Practice Tally Study-6 |

58 |

|

Tally.125 |

Solutions To Practice Tally Study-1 (Tally.119) |

59-67 |

|

Tally.126 |

Solutions To Practice Tally Study-1 (Tally.119)-snap shots |

68-109 |

Tally.100

HOW TO RUN EDUCATIONAL TALLY IN YOUR PC

· DOWNLOAD TALLY ERP9 FROM TALLY WEBSITE:

· RUN THE SETUP

· NOW TALLY ICON IS THERE ON YOUR DESKTOP

· DOUBLE CLICK THE ICON

· DOUBLE CLICK ON EDUCATIONAL MODE (OR ALT+W)

· NOW CREATE A COMPANY

· FOLLOW THE CHAPTER WISE STUDY NOTES

Tally.101

Creation of Company and Statutory Setting of GST

Tally 101

Creation of Company

↓

Gateway of tally(GOT)

↓

Alt+F3

↓

Create Company

↓

Fill the required particulars

(Note: if no company is available just press ‘C’ to Create Company)

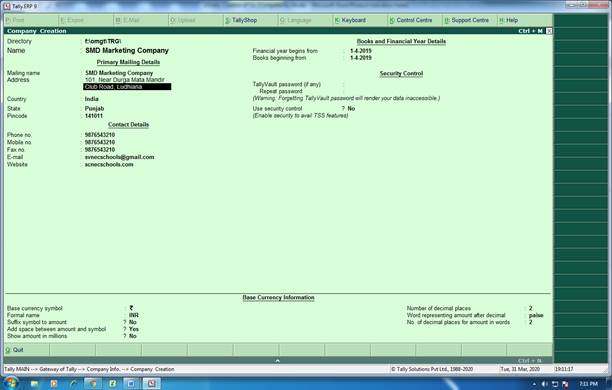

Creation of Company-Example

Mr. N. Aggarwal started business in the name of M/s SMD Marketing Co. with Rs.5,00,000/- by cheque and deposited the same in ICICI Bank by opening a new account.

Solutions:

Now we have to create SMD Marketing Company. Suppose address of the Company is 101, Near Durga Mata Mandir, Club Road, Ludhiana Punjab-141001 mobile number is 9876543210 email id is svnecschools@gmail.com

Use Alt+f3 or Create Company and fill the particulars:

Your page view shall be as under:

Tally-101-A

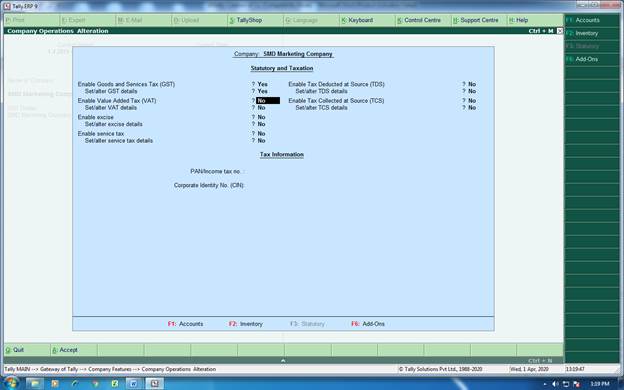

Statutory Setting of GST

Gateway of tally (GOT)

↓

Press ‘F11’ (Features)

↓

Press ‘S’ (Statutory & Taxation)

↓

Enable GST-yes

↓

Set/Alter GST Details-yes

↓

Enter GST Number and set other particulars

The view shall be as under:

Tally 102

Creation of Ledger Account

↓

Gateway of tally (GOT)

↓

Press ‘A’ for Accounts Information

↓

Press ‘L’ for Ledger

↓

Press ‘C’ for Create

(In short GOT-ALC)

Creation of Ledger Account-Example

(Already created M/s SMD Marketing Co.)

Problem

Mr. N. Aggarwal started business in the name of M/s SMD Marketing Co. with Rs.5,00,000/- by cheque and deposited the same in ICICI Bank by opening a new account.

Solutions:

Press ‘A’ then ‘L’ then ‘C’ at GOT (Gateway of Tally)

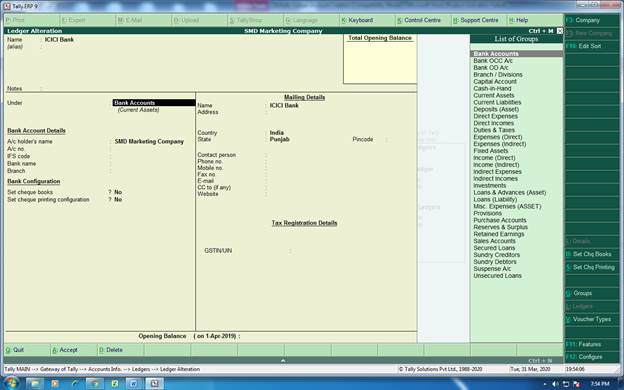

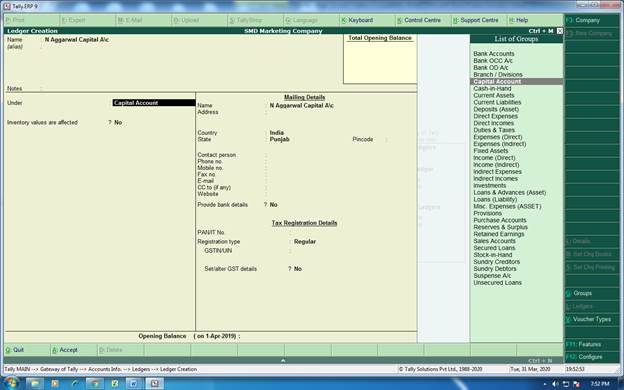

Every accounting transaction has two ledger accounts. In tally there is a need to allot “Under Group” to each and every ledger account. These groups are pre-defined in tally. Here are two accounts for above entry:

|

|

Ledger Account |

Under Group |

|

1 |

N. Aggarwal Capital A\c |

Capital Account |

|

2 |

ICICI Bank |

Bank Accounts |

The view of ledger accounts shall be as under:

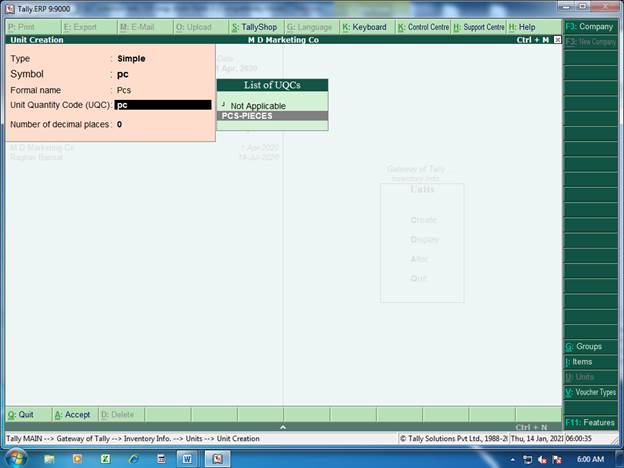

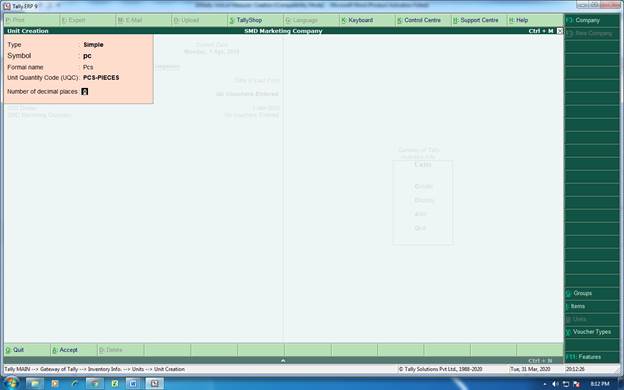

Tally 103

Creation of Unit of Measure

(e.g. pcs, kgs, ltrs etc.)

↓

Gateway of tally (GOT)

↓

Press ‘I’ for Inventory Info.

↓

Press ‘U’ for Unit of Measure

↓

Press ‘C’ for Create

(In short GOT-IUC)

↓

Fill the particulars

↓

Symbol as ‘Pc’

↓

Formal Name as –Piece

↓

Number of Decimal Places as required

Creation of Unit of Measure -Example

(Already created company named M/s SMD Marketing Co.)

Problem

He purchased the following goods on credit from M\s Maharaj & Company, Ludhiana Punjab:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Input CGST |

Input SGST |

Total |

|

Speaker |

100 |

600 |

60000 |

6% |

6% |

67200 |

Solutions:

In the above problem unit of measure is ‘Pc’ (Piece). To create the same Press ‘I’ then ‘U’ then ‘C’ at GOT (Gateway of Tally). After filling required particulars the view is as under:

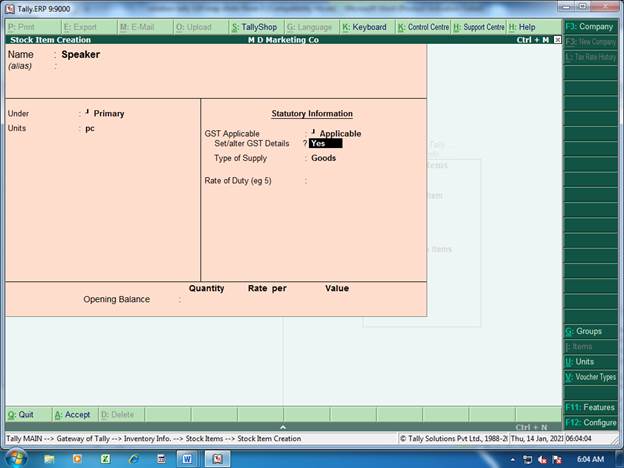

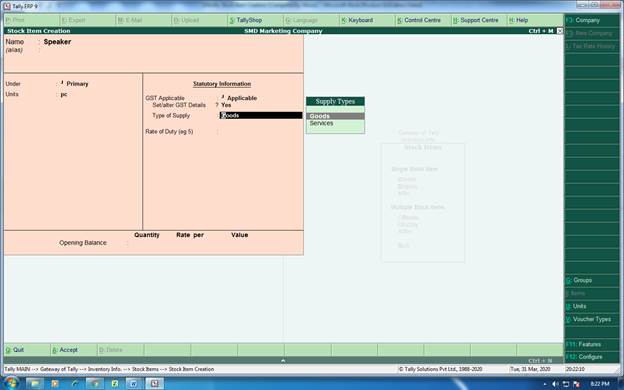

Stock Item Creation

Tally 104

Creation of Stock Item

↓

Gateway of tally (GOT)

↓

Press ‘I’ for Inventory Info.

↓

Press ‘I’ for Stock Item

↓

Press ‘C’ for Create

(In short GOT-IIC)

Creation of Stock Item -Example

(Already created company named M/s SMD Marketing Co.)

Problem

He purchased the following goods on credit from M\s Maharaj & Company, Ludhiana Punjab:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Input CGST |

Input SGST |

Total |

|

Speaker |

100 |

600 |

60000 |

6% |

6% |

67200 |

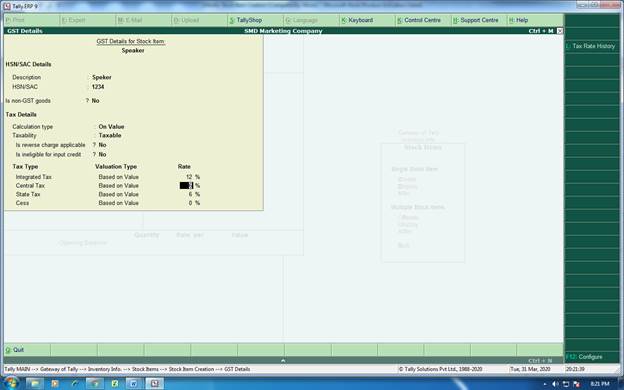

Solutions:

In the above problem stock item is “speaker” and GST rate is 12% (6+6). To create the same Press ‘I’ then ‘I’ then ‘C’ at GOT (Gateway of Tally). After filling required particulars the view is as under:

Tally 105

Creation of Accounting Voucher

↓

Gateway of tally (GOT)

↓

Press ‘F4’ for Contra Voucher Entry

or

Press ‘F5’ for Payment Voucher Entry

or

Press ‘F6’ for Receipt Voucher Entry

Or

Press ‘F7’ for Journal Voucher Entry

Or

Press ‘F8’ for Sale Bill Preparation

Or

Press ‘Ctrl+F8’ for Credit Note Entry

Or

Press ‘F9’ for Purchase Bill Entry

Or

Press ‘Ctrl+F9 for Debit Note Entry

(All Such short keys are available at GOT right side no need to learn only for reference)

Tally 106

Contra Voucher Creation

The said voucher is used for

Cash Deposit

or

Cash Withdrawal

or

Inter Bank Transfer

(Business Houses banked with more than one bank)

(A) -For Cash Deposit

↓

Gateway of tally (GOT)

↓

Press ‘F4’ for Contra Voucher Entry

↓

Account: Name of the Bank

↓

Particulars: Cash

(B)-For Cash Withdrawl

↓

Gateway of tally (GOT)

↓

Press ‘F4’ for Contra Voucher Entry

↓

Account: Cash

↓

Particulars: Name of the Bank

(C)-Inter Bank Transfer

↓

Gateway of tally (GOT)

↓

Press ‘F4’ for Contra Voucher Entry

↓

Account: Receiver Bank Name (Where amount deposited)

↓

Particulars: Payer Bank (from where amount withdrawn)

Contra Voucher Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem

1. Mr. Aggarwal deposited Rs.5, 000/- at ICICI bank.

2. Mr. Aggarwal withdrew Rs.50, 000/- from ICICI bank for office use.

3. Mr Aggarwal opens another bank account at HDFC Bank and transfer a sum of Rs.10000/- from ICICI bank

Solutions:

In the above problems only one new ledger account has to create as other account are already created or available in tally. To create HDFC account GOT-ALC.

For contra voucher creation the same Press ‘V’ at GOT (Gateway of Tally) and then F4 for contra voucher.

Solution to Problem 1 shall be as under:

Account: ICICI Bank

Particulars: Cash

Solution to Problem 2 shall be as under:

Account: Cash

Particulars: ICICI Bank

Solution to Problem 3 shall be as under:

Account: HDFC Bank

Particulars: ICICI Bank

Tally 107

Payment Voucher Creation

The said voucher is used for

Any type of Cash or Bank Payment

(A) -For Cash Payments

↓

Gateway of tally (GOT)

↓

Press ‘F5’ Payment

↓

Account: Cash

↓

Particulars: Payment Accounting Head

(Like salary, wages, cash expenses and payment to creditors)

(B)-For Bank Payments

↓

Gateway of tally (GOT)

↓

Press ‘F5’ Payment

↓

Account: Name of the Bank

↓

Particulars: Payment Accounting Head

(Like salary, wages, expenses and payment to creditors through cheque or Bank Transfer, Bank Charges or Bank Interest Paid)

Payment Voucher Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem

|

|

|

Solutions:

In the above three problems new ledger accounts are

Computer A\c under Fixed Assets

Old clothes for dusting a\c” or Miscellaneous Expenses under Indirect Expenses

Entertainment Expenses under Indirect Expenses

For Voucher Creation press ‘V’ at GOT (Gateway of Tally) and ‘F5’ for payment voucher.

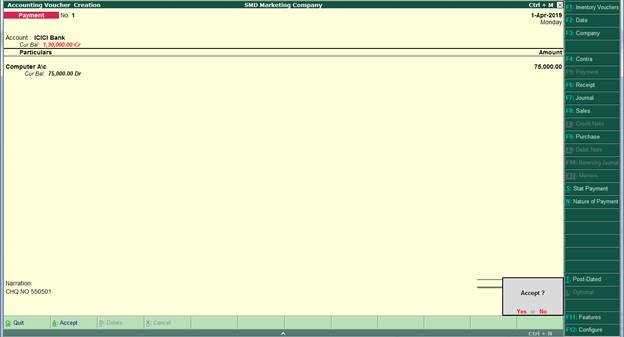

Solution to Problem 1

Account: ICICI Bank

Particulars: Computer a\c

The view shall be as under:

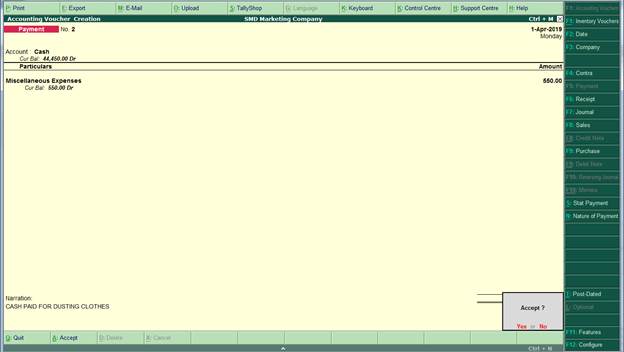

Solution to Problem 2

Account: Cash

Particulars: Miscellaneous Expenses A\c

The view shall be as under:

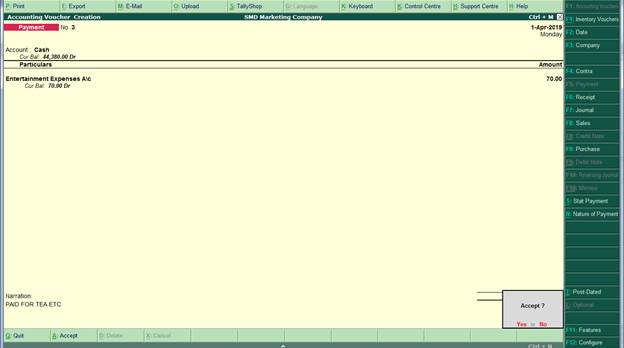

Solution to Problem 3

Account: Cash

Particulars: Entertainment Expenses A\c

The view shall be as under

Tally 108

Receipt Voucher Creation

The said voucher is used for

Any type of Cash or Bank Receipt

(A) -For Cash Receipts

Gateway of tally (GOT)

↓

Press ‘F6’ Receipt

↓

Account: Cash

↓

Particulars: Receipt Accounting Head

(Like capital introduced, cash received from debtors, Misc. Receipts etc)

(B)-For Bank Receipts

↓

Gateway of tally (GOT)

↓

Press ‘F6’ Receipt

↓

Account: Name of the Bank

↓

Particulars: Receipt Accounting Head

(Like capital introduced, cheque or bank transfer from debtors, Misc. Receipts through cheque or Bank Transfer, bank interest received)

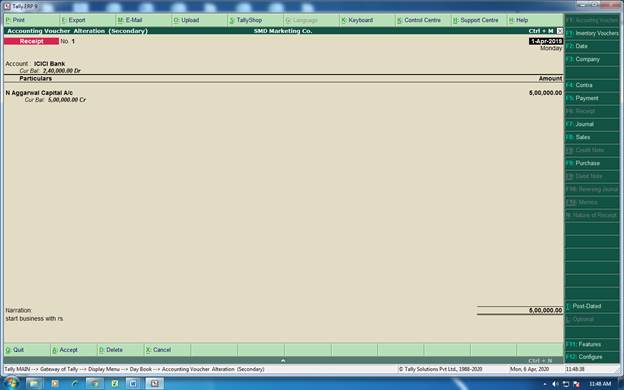

Receipt Voucher Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem

Mr. N. Aggarwal started business in the name of M\s SMD Marketing Co. with Rs.5,00,000/- by cheque and deposited the same in ICICI Bank by opening a new account.

Solutions:

In the above problem following ledger accounts are already created:

N.Aggarwal Capital A\c under Capital Account

ICICI bank under bank Accounts

For Voucher Creation press ‘V’ at GOT (Gateway of Tally) and ‘F6’ for Receipt voucher.

Account: ICICI Bank

Particulars: N. Aggarwal Capital A\c

The view shall be as under:

Tally 109

Journal Voucher Creation

The said voucher is used for

“Any type of Non-Cash or Non-Bank transaction, Fixed Assets (Non-Gst) purchased through credit, Credit Expenses (Non-gst), Adjustment entries like Rebate & Discount, Depreciation, transfer of one a\c to other, salary wages, other payable expenses, Prepaid Insurance and Expenses Receivable etc.”

Gateway of tally (GOT)

↓

Press ‘F7’ Journal

↓

Fixed Asset Purchase (Credit and Non-GST)

DR: Name of the Asset

CR: Name of the Creditor from where purchased

Expenses (Credit and Non-GST)

DR: Expenses Head

CR: Name of the Creditor from where purchased

Salary & Wages Paid (Credit and Non-GST)

DR: Salary/Wages Paid

CR: Salary & Wages Payable

Journal Voucher Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem

1. Discount allowed Rs.100/- on receipt of payment from ABC & Co.

2. Discount received Rs.210/- on for making payment to XYZ & Co.

3. Depreciation on computer Rs.4000/- (40% on Rs.10000/-)

4. Salary due for April Rs.27000/-

Solutions:

In the above problems following ledger accounts are required to create:

Rebate & Discount A\c under Indirect Expenses or Indirect Income

ICICI bank under bank Accounts

ABC & Co. under Sundry Debtors

XYZ /& Co. under Sundry Creditors

Depreciation Account under Fixed Assets

Salary paid under Indirect Expenses

Salary Payable under Current Liabilities

For Voucher Creation press ‘V’ at GOT (Gateway of Tally) and ‘F7’ for Journal voucher.

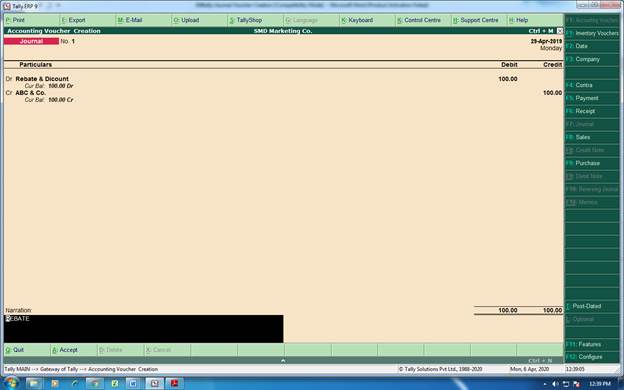

Problem:1

Dr: Rebate & Discount

CR: ABC & Co.

The view shall be as under:

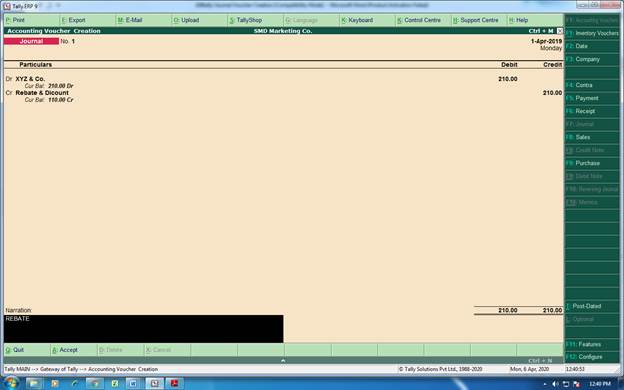

Problem: 2

Dr: XYZ & Co.

CR: Rebate & Discount

The view shall be as under:

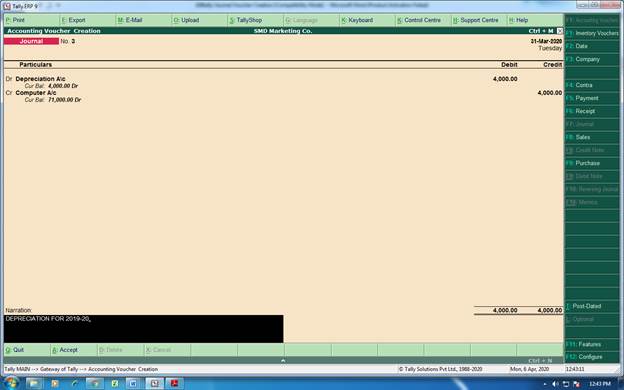

Problem:3

Dr: Depreciation A\c

CR: Computer A\c

The view shall be as under:

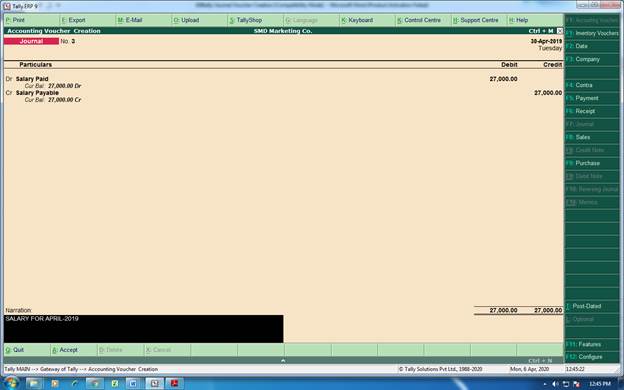

Problem: 4

Dr: Salary Paid A\c

CR: Salary Payable A\c

The view shall be as under:

Tally 110

Sale Bill Preparation

The said voucher is used to

“To prepare cash or credit sale invoice with in the state and out of state”

Ledger Accounts required for preparing a Sale Invoice:

(Follow Tally.102)

1 Cash-already available in the tally-under Cash in hand

2a- Party Ledger account (for state sale)-Under Sundry Debtors with state particulars.

2b- Party Ledger account (for Inter-state sale)-Under Sundry Debtors with outside state particulars.

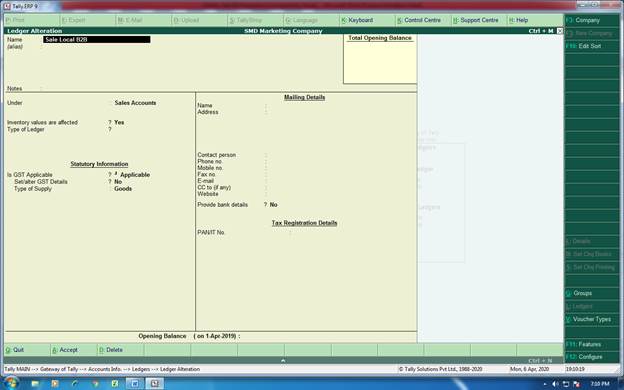

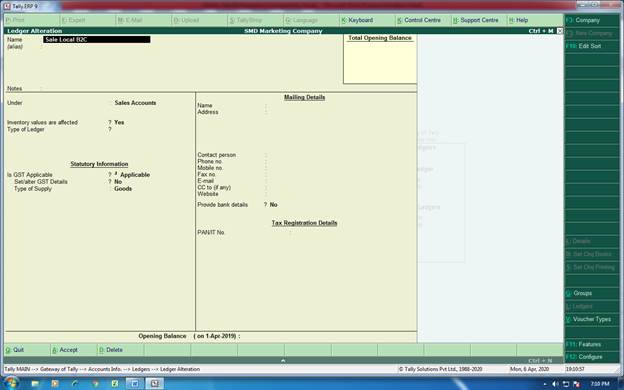

3 Sale Local B2b-Under Sales Account

4 Sale Local B2c-Under Sales Account

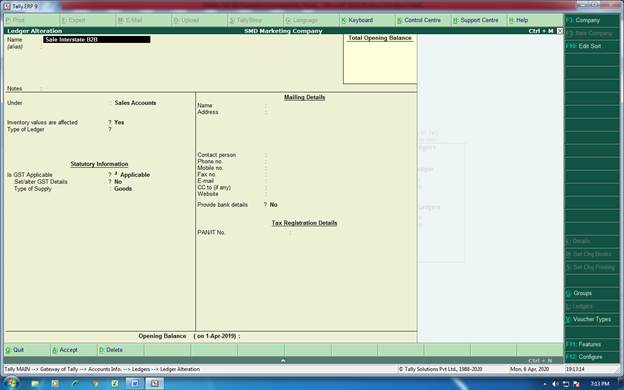

5 Sale Interstate B2b-Under Sales Account

6 Sale Interstate B2c-Under Sales Account

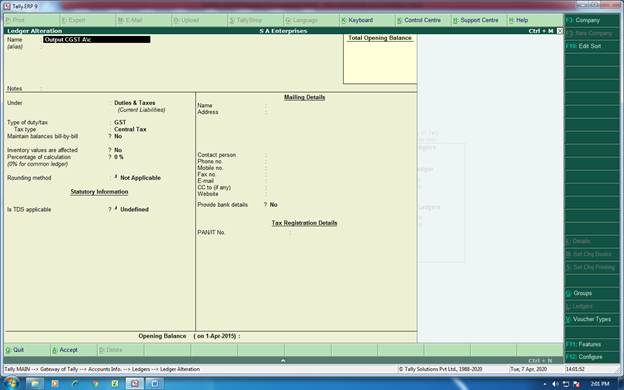

7 Output CGST A\c-Under Duties & Taxes-Central Tax

8 Output SGST A\c-Under Duties & Taxes-State Tax

9 Output IGST A\c-Under Duties & Taxes-Integrated Tax

10 Round off A\c-Under Indirect Expenses

Stock Item to Open by Using Tally.103 & Tally.104 with GST rate

Gateway of tally (GOT)

↓

Press ‘F8’ Sale

↓

A For Cash State Sale

Party Name-Cash

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output CGST A\C-(Calculate automatically)

Write Output SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

B For Credit State Sale

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output CGST A\C-(Calculate automatically)

Write Output SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

C For Credit Inter-State Sale

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output IGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

(Such transactions shall automatically be possible by using “Sale Voucher type Creation)

Sale Bill Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem 1-Within State Sales-Cash

Sold the following goods in cash:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output CGST |

Output SGST |

Total |

|

Speaker |

50 |

850 |

42500 |

6% (2550/-) |

6% (2550/-) |

47600 |

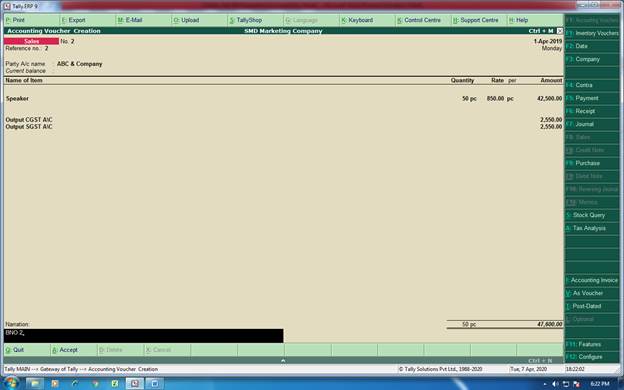

Problem 2-Within State Sales-Credit

Sold the following goods in to ABC & Company, Ludhiana, Punjab having GST number on credit:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output CGST |

Output SGST |

Total |

|

Speaker |

50 |

850 |

42500 |

6% (2550/-) |

6% (2550/-) |

47600 |

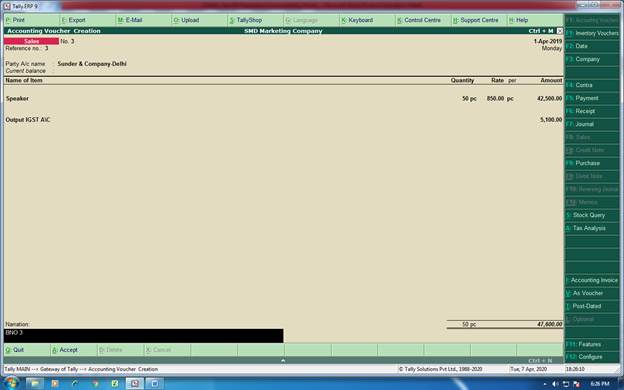

Problem 3-Inter State Sales-Credit

Sold the following goods in to Sunder & Company, Delhi having GST number on credit:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output IGST |

Total |

|

Speaker |

50 |

850 |

42500 |

12% (5100/-) |

47600 |

Solutions

(A) In the above problems following ledger accounts are required to create by using GOT-ALC:

LEDGER ACCOUNT-GOT-ALC-Sale Local B2b-Under Sales Account

Ledger Account-GOT-ALC-Sale Local B2c-Under Sales Account

Ledger Account-GOT-ALC-Sale Interstate B2b-Under Sales Account

Ledger Account-GOT-ALC-Output CGST A\c-Under Duties & Taxes-Central Tax

Ledger Account-GOT-ALC-Output SGST A\c-Under Duties & Taxes-State Tax

Ledger Account-GOT-ALC-Output IGST A\c-Under Duties & Taxes-Integrated Tax

Cash Account-already exists

Ledger Account-GOT-ALC-ABC & Company Ludhiana with GST number and state Punjab under Sundry Debtors

Ledger Account-GOT-ALC-Sunder & Company, Delhi with GST number and state Delhi under Sundry Debtors

(B) Unit of measure ‘pc’ is required to create by using GOT-IUC

‘(C) Stock Item “Speaker” is required to create by using GOT-IIC

Problem 1

GOT-V-F8-SALES-View is as under:

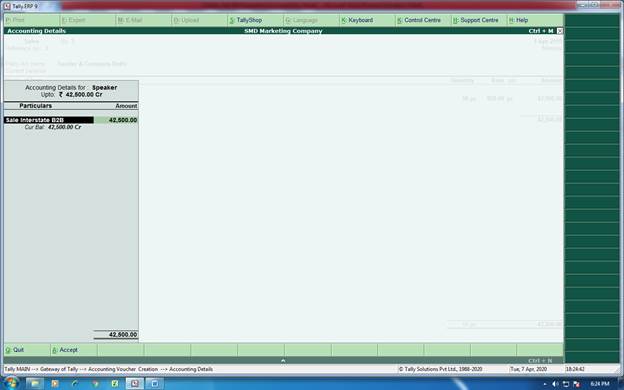

Problem 2

GOT-V-F8-SALES-View is as under:

Problem 3

GOT-V-F8-SALES-View is as under:

This screen also appears for selection of sales

Tally 111

Purchase Bill Entry

The said voucher is used to

“To enter cash or credit Purchase of Goods, GST claimable expenses, Fixed Assets, RCM Entry with in the state and out of state”

Ledger Accounts to enter a Purchase Invoice:

(Follow Tally.102)

1 Cash-already available in the tally-under Cash in hand

2a- Party Ledger account (for state Purchase)-Under Sundry creditors with state particulars.

2b- Party Ledger account (for Inter-state Purchase)-Under Sundry Creditors with outside state particulars.

3 Purchase Local B2b-Under Purchase Account

4 Purchase Interstate B2b-Under Sales Account

5 Input CGST A\c-Under Duties & Taxes-Central Tax

8 Input SGST A\c-Under Duties & Taxes-State Tax

9 Input IGST A\c-Under Duties & Taxes-Integrated Tax

10 Round off A\c-Under Indirect Expenses

11 Particular Expenses a\c-under Indirect Expenses

12 Asset a\c-under Fixed Assets

Stock Item to Create by Using Tally.103 & Tally.104 with GST rate

Gateway of tally (GOT)

↓

Press ‘F9’ Purchase

↓

A For Cash State Purchase

Party Name-Cash

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Input CGST A\C-(Calculate automatically)

Write Input SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

B For Credit State Purchase

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Input CGST A\C-(Calculate automatically)

Write Input SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

C For Credit Inter-State Purchase

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Input IGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

(Such GST Calculations shall automatically be possible by using Purchase Voucher type Creation)

Purchase Bill Entry -Example

(Already created company named M/s SMD Marketing Co.)

Problem 1-Within State -Cash Purchase

|

He purchased the following goods in cash from M\s Maharaj & Company, Ludhiana Punjab:

|

Problem 2- Within State -Credit Purchase

He purchased the following goods on credit from m\s Maharaj & Company, Ludhiana:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Input CGST |

Input SGST |

Total |

|

Seat Cover |

50 |

1500 |

75000 |

9% |

9% |

88500 |

|

Seat Cover |

100 |

2000 |

200000 |

9% |

9% |

236000 |

|

|

|

|

|

|

Total |

324500 |

Problem 3- Inter State Purchase-Credit

He purchased the following goods on credit from M\s Shakti Enterprirses., Delhi:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Input IGST |

Total |

|

Perfume |

100 |

400 |

40000 |

12% |

44800 |

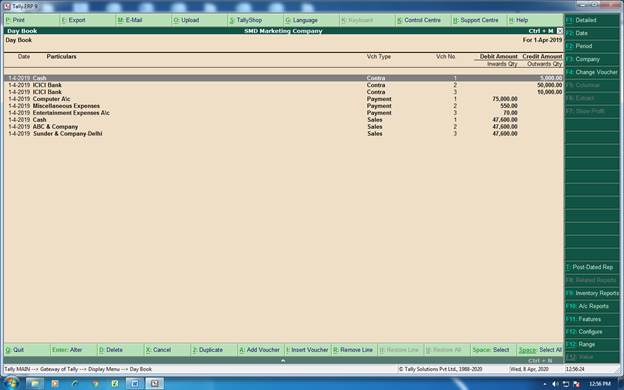

Tally 112

How to check the entries made?

↓

Gateway of tally (GOT)

↓

Press ‘D’ for Display

↓

Press ‘D’ for Day Book

(In short GOT-DD)

The view shall be as under:

Tally 113

How to repeat narration in tally voucher

↓

Gateway of tally (GOT)

↓

Press ‘V’ for Accounting Vouchers

↓

Create a Voucher (Suppose f6 for receipt)

↓

Type a Narration

↓

Now Create Next Receipt Voucher

↓

Press alt+R

The same narration appears

Tally 114

How to copy narration in tally voucher

↓

Gateway of tally (GOT)

↓

Press ‘V’ for Accounting Vouchers

↓

Create a Voucher (Suppose f6 for receipt)

↓

Type a Narration

↓

Now Press Control+alter+C

↓

The narration is copied

↓

To paste the same it at another voucher

Press Control+alter+V

Tally 115

How to see Party Account or Ledger Balance

↓

Gateway of tally (GOT)

↓

Press ‘D’ for Display

↓

Press ‘A’ for Account Books

↓

Press ‘L’ for Ledger

↓

Now Type the Ledger Name

↓

Select the period Press F2

Tally.118

Tally 118-A

Direct Expenses

(Purchase/Cost of Goods related Expenses)

↓

List

|

sno |

Accounting Head |

Remarks |

|

|

Wages |

Payment related to Production |

|

|

Custom Clearing Expenses Import |

Paid for incoming material |

|

|

Electricity Expenses (Factory) |

Payment related to Production |

|

|

Factory Rent |

Paid for Factory premises used for production or Godown for Production Material |

|

|

Freight & Cartage Inward |

Paid for incoming material |

|

|

Generator Expenses (Factory) |

Payment related to Production |

|

|

Import Duty |

For import of Goods |

|

|

Labor Outward |

Labor paid for process of Production |

|

|

Loading/Unloading Expenses Inward |

Paid for incoming material |

Tally 118-B

Indirect Expenses

(All expenses incurred when Goods are ready for sale)

↓

List

|

S.No |

Accounting Head |

Remarks where required |

|

|

Accounting Charges |

|

|

|

Advertisement Expenses |

|

|

|

Audit Fee |

|

|

|

Bad Debts A\c |

|

|

|

Bank Charges |

|

|

|

Bank Interest |

|

|

|

Bonus Account |

|

|

|

Building Repair & Maintenance |

|

|

|

Bus Expenses |

For Staff Bus or In Educational Institutions |

|

|

Camera Repair |

|

|

|

Commission Expenses |

|

|

|

Computer Repair & Maintenance |

|

|

|

Consultation Charges |

|

|

|

Conveyance Expenses |

|

|

|

Courier Charges |

|

|

|

Depreciation Account |

|

|

|

Diesel Expenses |

|

|

|

Distribution Expenses |

|

|

|

Educational Tour Expenses |

In Educational Institutions |

|

|

Educational Software Charges

|

In Educational Institutions |

|

|

Electric Repair & Maintenance |

|

|

|

Entertainment Expenses |

|

|

|

ESI Employer Share |

|

|

|

Examination Expenses

|

|

|

|

Exhibition Expenses A/C |

|

|

|

Festival Celebration Expenses |

|

|

|

Fee & Taxes |

|

|

|

Fire Extinguishers Expenses |

|

|

|

Freight & Cartage Outward |

|

|

|

Function/Competition Expenses |

In Educational Institutions |

|

|

Furniture Repair Expenses |

|

|

|

General Repair & Maintenance |

|

|

|

House Keeping Expenses |

|

|

|

Income Tax Provision |

|

|

|

Identity Card Charges |

In Educational Institutions |

|

|

Insurance |

|

|

|

Insurance A\c (Director)-Key |

|

|

|

Interest on Capital |

|

|

|

Interest on Loan |

|

|

|

Interest on TDS Deposit |

|

|

|

Interest on Unsecured Loans |

|

|

|

Labor Welfare Expenses |

|

|

|

Labor Welfare Fund |

|

|

|

Laboratory Expenses |

In Educational Institutions |

|

|

Leave with Wages |

|

|

|

Legal Fee Expenses |

|

|

|

License Fee-Factory Act |

|

|

|

Loading/Unloading A\c (sales) |

|

|

|

Loss By Fire |

|

|

|

Machinery Repair & Maintenance |

|

|

|

Medical Aid |

|

|

|

Miscellaneous Expenses |

|

|

|

News Paper & Periodicals |

|

|

|

Office Expenses |

|

|

|

Old Cloth for Dusting |

|

|

|

Petrol Expenses |

|

|

|

Photo Copy Expenses |

|

|

|

Postage Account |

|

|

|

Printing & Stationery |

|

|

|

Professional Fee |

|

|

|

Provident Fund (Employer Share) |

|

|

|

Rebate & Discount |

|

|

|

Remuneration to Directors |

|

|

|

Rent Paid A\c |

Shop Rent, Office Building, Godown of Finished Goods and Showroom Rent |

|

|

Repair & Maintenance |

|

|

|

Repair & Maintenance Vehicles |

|

|

|

Royalties A\c |

|

|

|

Salary Paid |

Office/Selling Staff |

|

|

Salary to Partners |

|

|

|

Sale Promotion Expenses |

|

|

|

Sales Tax Assessment Charges |

|

|

|

Scouts & Guide Training |

In Educational Institutions |

|

|

Seminar Expenses |

In Educational Institutions |

|

|

Shipping Charges Outward |

|

|

|

Shop Alteration Expenses |

|

|

|

Software Charges |

|

|

|

Staff Welfare |

|

|

|

Subscription Account |

|

|

|

Sports Expenses |

In Educational Institutions |

|

|

Staff Training |

|

|

|

TDS A\c-Regular Assessment/Late Fee |

|

|

|

Telephone Expenses |

|

|

|

Trade Mark Registration Expenses |

|

|

|

Travelling Expenses |

|

|

|

Tree & Plantation Expenses |

|

|

|

Uniform Expenses |

|

|

|

Vehicle Road Tax |

|

|

|

Water & Sewerage Expenses |

|

|

|

Water Cooler Repair |

|

|

|

Website Development Charges |

|

TALLY-119

PRACTICE TALLY STUDY-CHAPTER-1

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||||||||||||||||

|

101 |

APR-1 |

Mr. N. Aggarwal started business in the name of M\s M D Marketing Co. with Rs.5,00,000/- by cheque and deposited the same in ICICI Bank by opening a new account. |

||||||||||||||||||||||||||||

|

102 |

Apr-2 |

Mr. Aggarwal withdrew Rs.50,000/- from ICICI bank for office use. |

||||||||||||||||||||||||||||

|

103 |

Apr-5 |

He purchased computer worth Rs.75000/- for office by paying a cheque no 550501. |

||||||||||||||||||||||||||||

|

104 |

Apr-6 |

He deposited rental security for office Rs.50,000/- by cheque number 550502. |

||||||||||||||||||||||||||||

|

105 |

Apr-8 |

He issued a cheque number 550503 to purchase the following assets:Furniture Rs.25000/- , Scooter Rs.40000/-, Mobile Phone Rs.15000/- and Cooler Rs.5000/-. |

||||||||||||||||||||||||||||

|

106 |

Apr-20 |

He purchased the following goods on credit from M\s Maharaj & Company, Ludhiana Punjab:

|

||||||||||||||||||||||||||||

|

107 |

Apr-21 |

He purchased the following goods on credit from M\s Shakti Enterprirses., Delhi:

|

||||||||||||||||||||||||||||

|

108 |

Apr-22 |

He purchased the following goods on credit from m\s Maharaj & Company, Ludhiana:

|

||||||||||||||||||||||||||||

|

109 |

Apr-23 |

He paid cartage inward Rs.500/- in cash on purchase made. |

||||||||||||||||||||||||||||

|

110 |

Apr-24 |

He paid cash Rs.280/- for medical aid to staff. |

||||||||||||||||||||||||||||

|

111 |

Apr-25 |

He take cash Rs.2000/- for personal use. |

||||||||||||||||||||||||||||

|

112 |

Apr-27 |

He paid Rs.7500/- in cash for packing material. |

||||||||||||||||||||||||||||

|

113 |

Apr-27 |

He paid Rs.1100/- as donation to a charitable trust. |

||||||||||||||||||||||||||||

|

114 |

Apr-28 |

He paid Rs.550/- in cash for old clothes for dusting. |

||||||||||||||||||||||||||||

|

115 |

Apr-29 |

He paid Rs.70/- in cash for tea to customers. |

||||||||||||||||||||||||||||

|

116 |

Apr-29 |

He paid Rs.700/- in cash for sweeper & watchman. |

TALLY-120

PRACTICE TALLY STUDY-CHAPTER-2

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||

|

201 |

May-1 |

Mr. Aggarwal paid salaries Rs.8500/- by cheque No. 550504 for April. |

||||||||||||||

|

202 |

May-2 |

He paid Rs.5000/- in cash to painter for office painting.. |

||||||||||||||

|

203 |

May-3 |

He paid Rs.2500/- in cash to M\s Baba travel Co. for travelling expenses. |

||||||||||||||

|

204 |

May-3 |

He paid Rs.2500/- in cash for stationery purchased. |

||||||||||||||

|

205 |

May-3 |

He paid Rs.600/- in cash for telephone bill. |

||||||||||||||

|

206 |

May-3 |

He paid Rs.450/- in cash for office Misc. Expenses. |

||||||||||||||

|

207 |

May-5 |

He paid Rs.250/- in cash for petrol expenses. |

||||||||||||||

|

208 |

May-6 |

Mr Aggarwal paid Rs.3500/- by cheque No. 550505 for office rent for April. |

||||||||||||||

|

209 |

May-10 |

He sold the following goods in cash:

|

||||||||||||||

|

210 |

May-12 |

He sold the following goods in cash:

|

||||||||||||||

|

211 |

May-15 |

He paid Rs. 67200/- cheque M\s Maharaj & Company vide cheque No.550506. |

||||||||||||||

|

212 |

May-18 |

He paid Rs 44800/- by cheque no 550507 to M\s Shakti Enterprirses and received discount Rs 1000/- |

||||||||||||||

|

213 |

May-20 |

Purchase the following goods by cash:

|

||||||||||||||

|

214 |

May-20 |

Paid Rs 230/- in cash for carriage on purchase made. |

||||||||||||||

|

215 |

May-21 |

He paid Rs. 70/- in cash for medical aid to labor. |

||||||||||||||

|

216 |

May-22 |

He withdrew Rs.4000/- in cash for personal use. |

||||||||||||||

|

217 |

May-25 |

He Paid Rs. 1500/- in cash for telephone bill. |

||||||||||||||

|

218 |

May-26 |

He paid Rs 1800/- in cash for electricity expenses of Shop. |

||||||||||||||

|

219 |

May-28 |

Paid Rs 200/- in cash for office misc. expenses. |

||||||||||||||

|

220 |

May-29 |

Paid Rs 45/- in cash for tea to customers. |

||||||||||||||

|

221 |

May-30 |

He paid Rs 450/- in cash for office repairs. |

||||||||||||||

|

222 |

May-30 |

He paid Rs 640/- in cash for packing material. |

TALLY-121

PRACTICE TALLY STUDY-CHAPTER-3

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||

|

301 |

Jun-3 |

He paid Rs 3500 in cash towards office rent for May month |

||||||||||||||

|

302 |

Jun-4 |

Mr Sunder paid salaries Rs 11500 by cheque no 55508 for May month |

||||||||||||||

|

303 |

Jun-6 |

Paid Rs 6000 in cash for wages for the May month |

||||||||||||||

|

304 |

Jun-8 |

He purchased the following goods on credit from Pacific Corporation:

|

||||||||||||||

|

305 |

Jun-9 |

He purchased the following goods on credit from Ramat Trading Co. on credit :

|

||||||||||||||

|

306 |

Jun-10 |

He paid Rs 400 in cash for carriage inward on purchase made |

||||||||||||||

|

307 |

Jun-12 |

Sold following goods on credit to Java Trading Co.:

|

||||||||||||||

|

308 |

Jun-13 |

Sold following goods on credit to Tridev Co.:

|

||||||||||||||

|

309 |

Jun-15 |

He withdrew Rs 5000 in cash for personal use |

||||||||||||||

|

310 |

Jun-20 |

He deposited cash Rs 20000 into ICICi bank |

||||||||||||||

|

311 |

Jun-25 |

He paid Rs 2000 in cash to Mr. Jairam as advance |

||||||||||||||

|

312 |

Jun-26 |

He paid Rs 2400 in cash for insurance premium |

||||||||||||||

|

313 |

Jun-27 |

Paid Rs 600 in cash for electricity expense of factory |

||||||||||||||

|

314 |

Jun-28 |

He paid Rs 550 in cash for office misc. expenses |

||||||||||||||

|

315 |

Jun-28 |

Paid Rs 500 in cash for petrol expenses |

||||||||||||||

|

316 |

Jun-29 |

Sold following goods on credit to Tridev Co.:

|

||||||||||||||

|

317 |

Jun-30 |

GST adjustment entry |

TALLY-122

PRACTICE TALLY STUDY-CHAPTER-4

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||||||||||||||||

|

401 |

Jul-3 |

Mr. Sunder paid Rs 11500 for slaries by cheque no 55509 for June Month |

||||||||||||||||||||||||||||

|

402 |

Jul-5 |

Paid Rs. 6200 in cash for wages to labour for the month June |

||||||||||||||||||||||||||||

|

403 |

Jul-6 |

Mr.Sunder paid Rs .3500 in cash for office rent for the month June |

||||||||||||||||||||||||||||

|

404 |

Jul-14 |

He purchased the following goods by cvheque no.55510

|

||||||||||||||||||||||||||||

|

405 |

Jul-19 |

He paid by cheque no.55511 Rs. 146250 to Pacific Corporation |

||||||||||||||||||||||||||||

|

406 |

Jul-20 |

He paid Rs. 499200 by cheque no.55512 to Rama Trading Co. |

||||||||||||||||||||||||||||

|

407 |

Jul-21 |

He sold the following goods on credit to Java Trading Co.

|

||||||||||||||||||||||||||||

|

408 |

Jul-21 |

He sold the following goods on credit to Data Tech Co.

|

||||||||||||||||||||||||||||

|

409 |

Jul-22 |

Received Rs. 61875 by cheque from Data tech co. |

||||||||||||||||||||||||||||

|

410 |

Jul-23 |

He paid Rs. 1500 in cash for advertisement & Rs.600 in cash for Donation |

||||||||||||||||||||||||||||

|

411 |

Jul-25 |

He paid Rs. 600 in cash towards electricity expenses of factory |

||||||||||||||||||||||||||||

|

412 |

Jul-25 |

Paid Rs. 550 in cash for office misc. expenses |

||||||||||||||||||||||||||||

|

413 |

Jul-29 |

Received Rs. 19406 by cheque from Jva Trading co. against bill on date 21/7 |

||||||||||||||||||||||||||||

|

414 |

Jul-29 |

He paid Rs.500 in cash for telephone bill |

||||||||||||||||||||||||||||

|

415 |

Jul-30 |

He received from Data Tech co. Rs.32906 by cheque |

||||||||||||||||||||||||||||

|

416 |

Jul-31 |

GST adjustment entry |

TALLY-123

TALLY STUDY-CHAPTER-5

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||

|

501 |

Aug-3 |

Mr. Sunder paid salaries by cheque no.55512 Rs 11500 for month July |

||||||||||||||

|

502 |

Aug-5 |

He paid Rs. 6200 in cash for wages to labour for the month July |

||||||||||||||

|

503 |

Aug-8 |

Paid Rs.3500 in cash towards office rent for the month July |

||||||||||||||

|

504 |

Aug-10 |

He sold the following goods on credit to Secret Trading corp. %trade dis. @5%:

|

||||||||||||||

|

505 |

Aug-15 |

Paid Rs.200 in cash for repairs |

||||||||||||||

|

506 |

Aug-20 |

Received Rs.86569 by cheque from Secret Trading co. |

||||||||||||||

|

507 |

Aug-25 |

Received a cheque from Java Trading co. for Rs 25313 against bill dated 12/5 |

||||||||||||||

|

508 |

Aug-27 |

He paid Rs.800 in cash for telephone bill |

||||||||||||||

|

509 |

Aug-27 |

Paid Rs.1600 in cash towards electricity expenses of factory |

||||||||||||||

|

510 |

Aug-28 |

He paid Rs.400 in cash for officer misc. expense |

||||||||||||||

|

511 |

Aug-28 |

Paid Rs. 350 in cash for petrol expenses |

||||||||||||||

|

512 |

Aug-28 |

Paid in cash Rs 850 for printing the bill books |

||||||||||||||

|

513 |

Aug-29 |

Paid Rs.420 in cash for old rags |

||||||||||||||

|

514 |

Aug-29 |

Received a cheque of Rs.78000 from Tridev co. |

||||||||||||||

|

515 |

Aug-30 |

Paid Rs.160 in cash for cold drinks & snacks to customers |

||||||||||||||

|

516 |

Aug-30 |

Purchased the following goods & payment made by cheque

|

||||||||||||||

|

517 |

Aug-30 |

Paid Rs. 770 in cash for octroi on purchase made. |

||||||||||||||

|

518 |

Aug-31 |

He paid Rs.1700 in cash to accountant as accounting charges |

||||||||||||||

|

519 |

Aug-31 |

He sold the following goods & received the cheque for the same

|

||||||||||||||

|

520 |

Aug-31 |

Paid Rs.450 in cash for carriage outward on sold goods. |

||||||||||||||

|

521 |

Aug-31 |

He sold the following goods & received the cheque for the same

|

||||||||||||||

|

522 |

Aug-31 |

GST adjustment entry |

TALLY-124

PRACTICE TALLY STUDY-CHAPTER-6

|

Entry No. |

DATE |

ENTRIES |

||||||||||||||||||||||||||||

|

601 |

Sep-4 |

Mr. Sunder paid salaries by cheque no.55513 Rs 11500 for month August |

||||||||||||||||||||||||||||

|

602 |

Sep-5 |

Paid Rs.3500 towards office rent by cheque no.55514 for the month August |

||||||||||||||||||||||||||||

|

603 |

Sep-6 |

He purchased the following goods on credit from A2Z Traders:

|

||||||||||||||||||||||||||||

|

604 |

Sep-7 |

He purchased the following goods on credit from Amar &co.

|

||||||||||||||||||||||||||||

|

605 |

Sep-8 |

Paid Rs.250 in cash for carriage inward on purchase made. |

||||||||||||||||||||||||||||

|

606 |

Sep-10 |

He sold the following goods on credit to Data Tech co.

|

||||||||||||||||||||||||||||

|

607 |

Sep-11 |

He sold the following goods on credit to Data Tech co.

|

||||||||||||||||||||||||||||

|

608 |

Sep-14 |

Vat payable Rs.1529.50 paid by cheque |

||||||||||||||||||||||||||||

|

609 |

Sep-15 |

Mr. Sunder withdrew Rs.6000 from ICICI bank for personal use |

||||||||||||||||||||||||||||

|

610 |

Sep-17 |

He sold the following goods on credit to Data Tech co.

|

||||||||||||||||||||||||||||

|

611 |

Sep-20 |

Paid Rs. 1020 in cash for electricity expenses of factory. |

||||||||||||||||||||||||||||

|

612 |

Sep-22 |

Paid in cash Rs 550 in cash for office misc. expenses. |

||||||||||||||||||||||||||||

|

613 |

Sep-25 |

Paid Rs.350 in cash for telephone bill. |

||||||||||||||||||||||||||||

|

614 |

Sep-27 |

He paid Rs.150 in cash for repairs. |

||||||||||||||||||||||||||||

|

615 |

Sep-28 |

Bank charges Rs.550 as half yearly bank charges |

||||||||||||||||||||||||||||

|

616 |

Sep-29 |

Received Rs.191875 by cheque from Data Tech co. |

||||||||||||||||||||||||||||

|

617 |

Sep-30 |

GSTadjustment entry |

Solutions to Practical Tally Study Chapter-1 (Tally-119)

Note: Due to Educational Mode Tally all entries in one date

Create Company

Create Company “M D Marketing Company” Ludhiana-Punjab India by using alt+F3 or create Company

Creation of Ledger Accounts

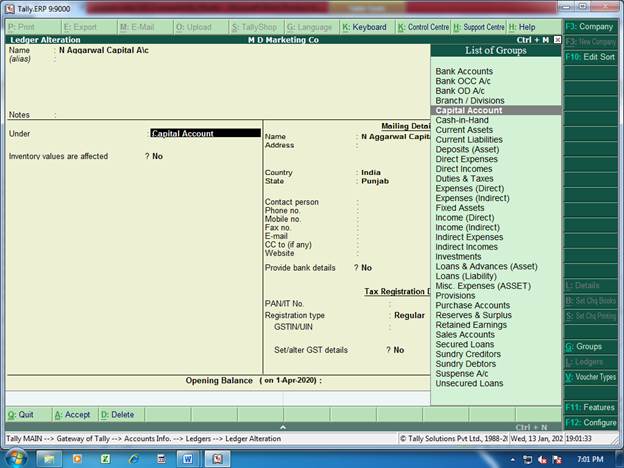

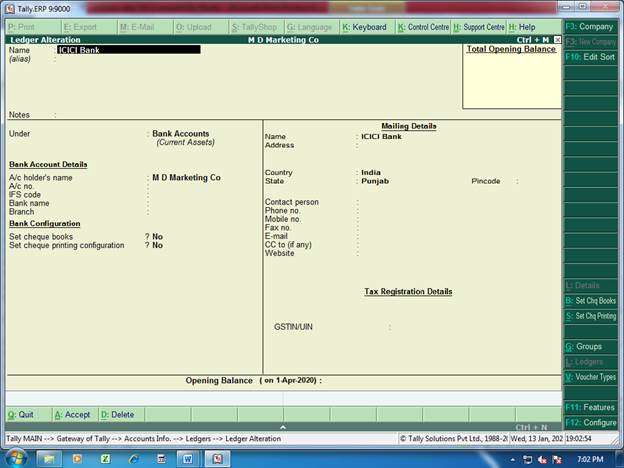

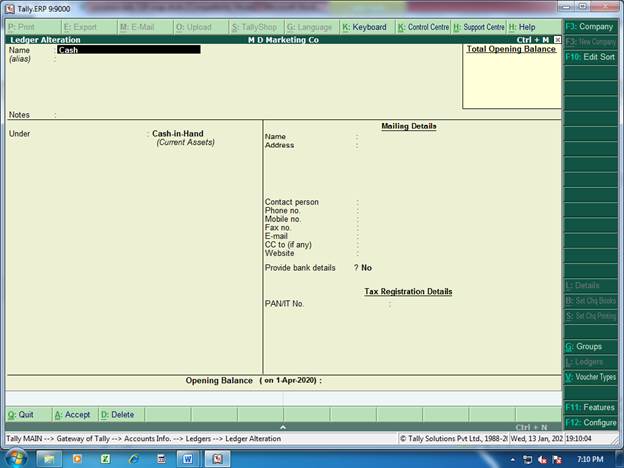

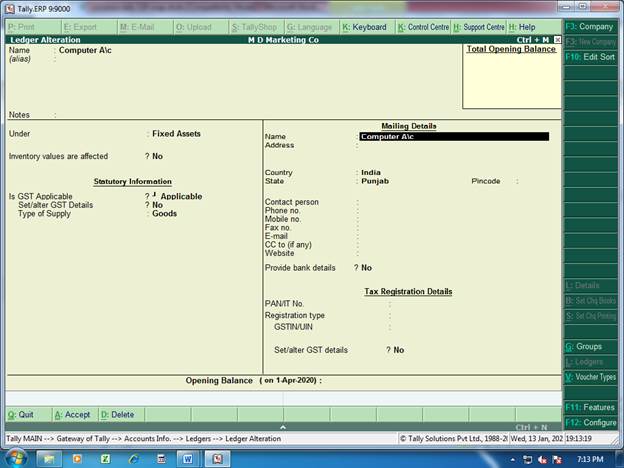

There are two accounting heads for each accounting transaction in Practical Tally Study Chapter-1 (Tally-119) total 16 accounting entries need the following ledger accounts

Open Ledger accounts by using GOT-A L C

|

Sno |

Accounting Ledger |

Under Group |

Photo |

|

1 |

N Aggarwal Capital A\c |

Capital Account |

1 |

|

2 |

ICICI Bank |

Bank Accounts |

2 |

|

3 |

Cash |

Already in Tally |

3 |

|

4 |

Computer A\c |

Fixed Assets |

4 |

|

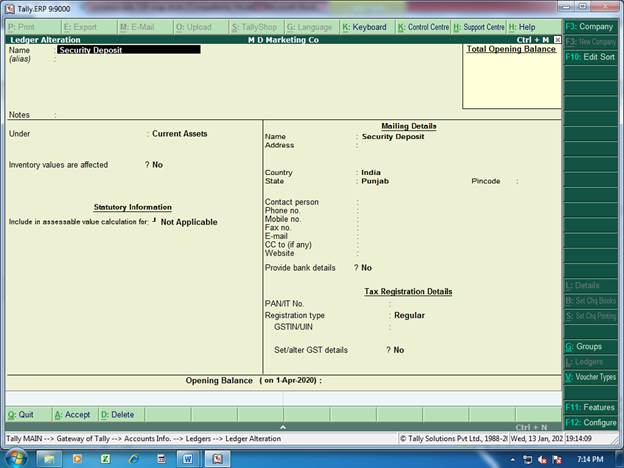

5 |

Security Deposit |

Current Assets |

5 |

|

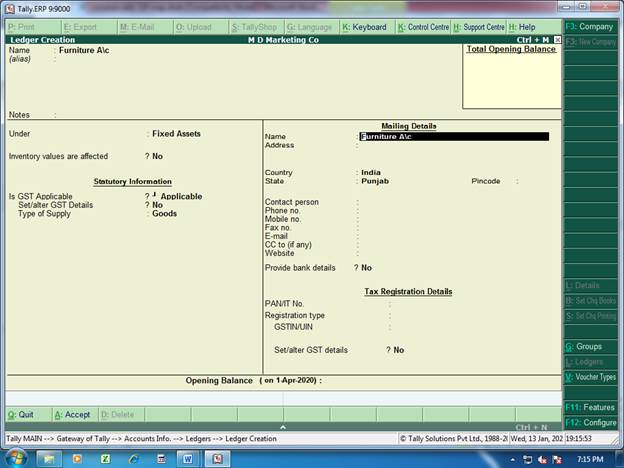

6 |

Furniture A\c |

Fixed Assets |

6 |

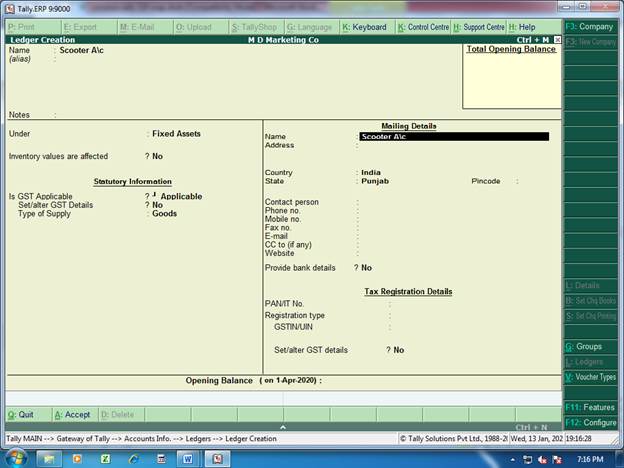

|

7 |

Scooter A\c |

Fixed Assets |

7 |

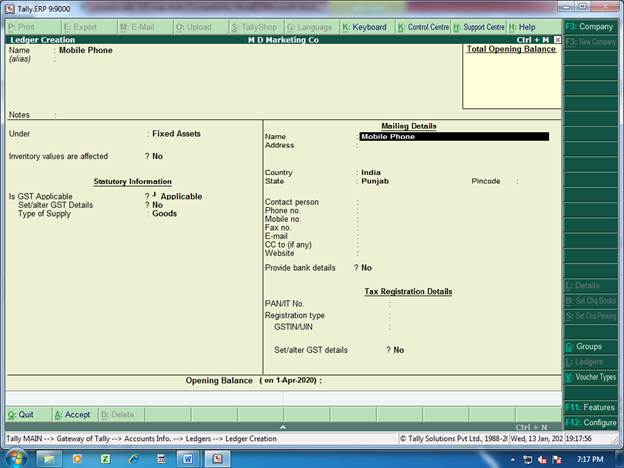

|

8 |

Mobile Phone |

Fixed Assets |

8 |

|

9 |

Cooler A\c |

Fixed Assets |

9 |

|

10 |

Purchase Local Pb |

Purchase Accounts |

10 |

|

11 |

Input CGST A\c |

Duties & Taxes-GST-Central Tax |

11 |

|

12 |

Input SGST A\c |

Duties & Taxes-GST-State Tax |

12 |

|

13 |

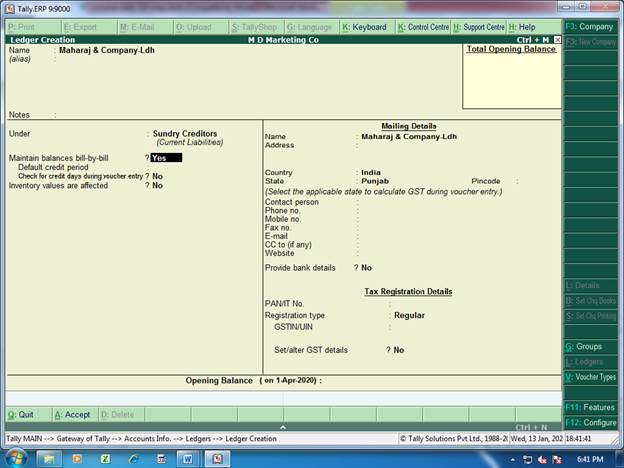

Maharaj & Company-Ldh |

Sundry Creditors |

13 |

|

14 |

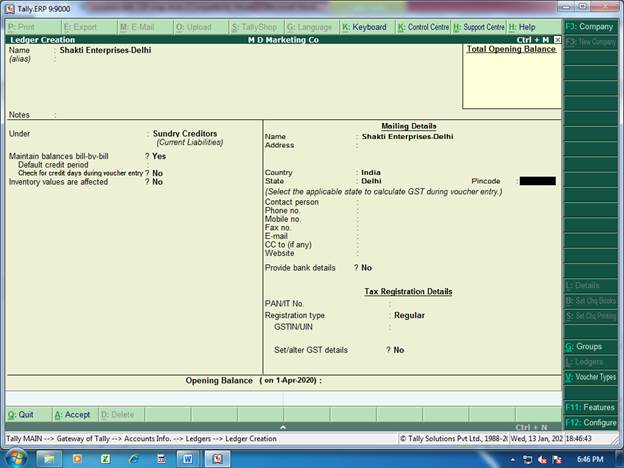

Shakti Enterprises-Delhi |

Sundry Creditors |

14 |

|

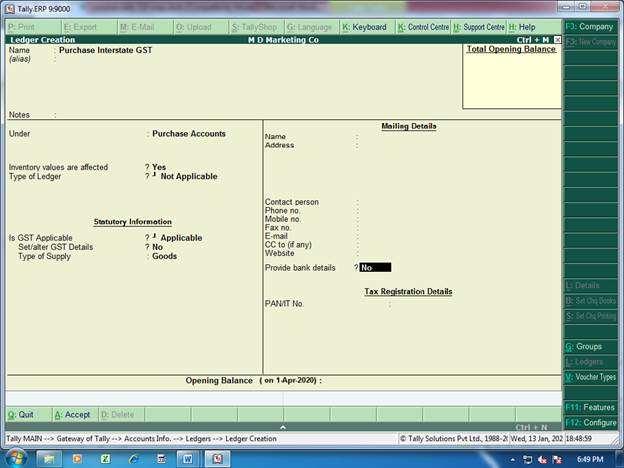

15 |

Purchase Interstate GST |

Purchase Accounts |

15 |

|

16 |

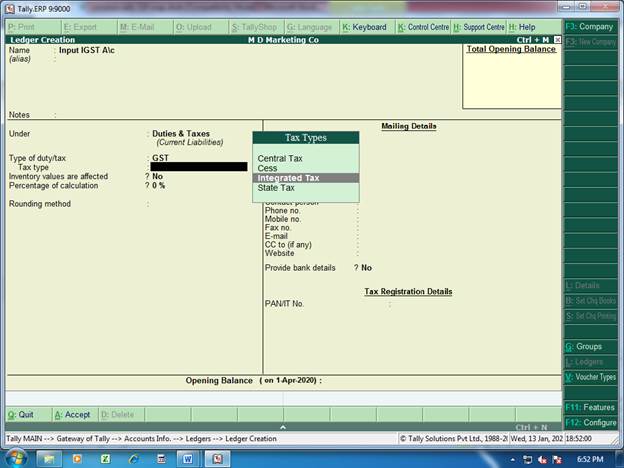

Input IGST A\c |

Duties & Taxes-GST-Integrated Tax |

16 |

|

17 |

Cartage Inward |

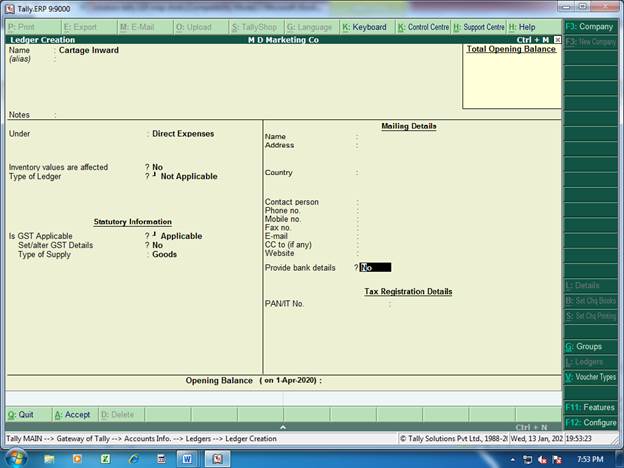

Direct Expenses |

17 |

|

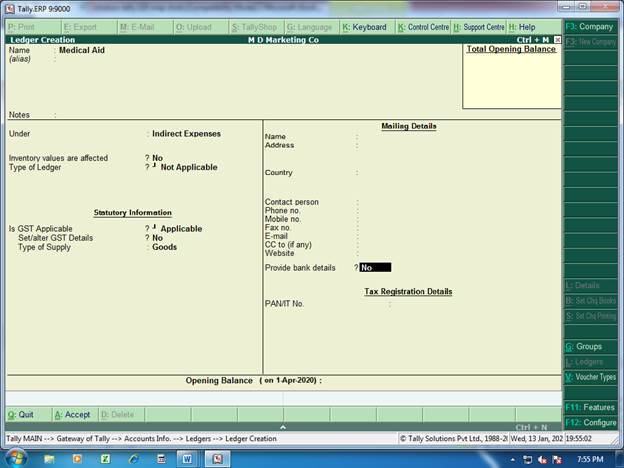

18 |

Medical Aid |

Indirect Expenses |

18 |

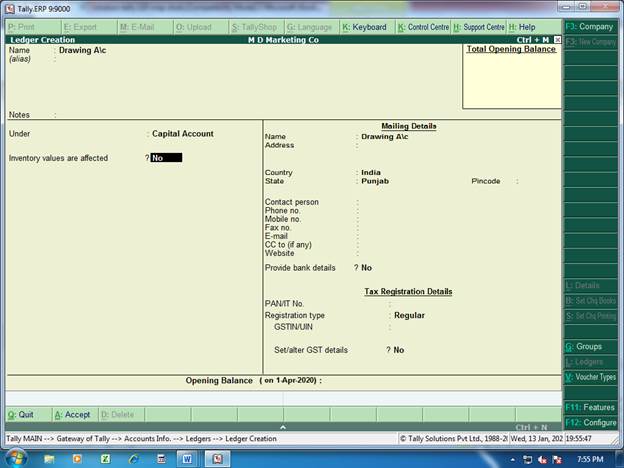

|

19 |

Drawing A\c |

Capital A\c |

19 |

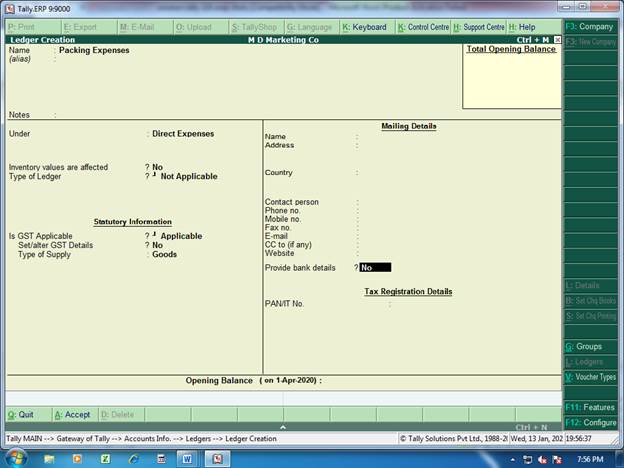

|

20 |

Packing Expenses |

Direct Expenses |

20 |

|

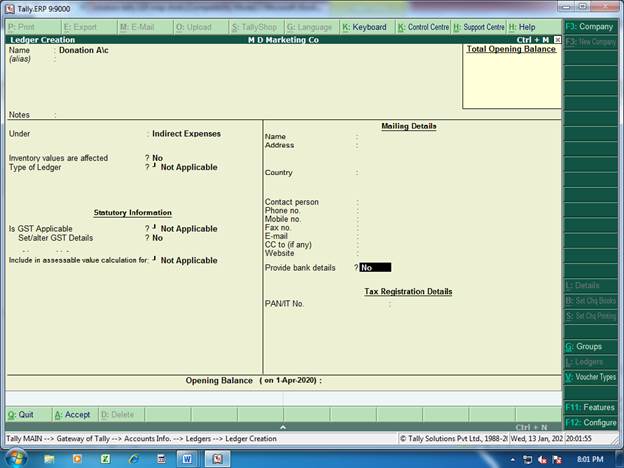

21 |

Donation A\c |

Indirect Expenses |

21 |

|

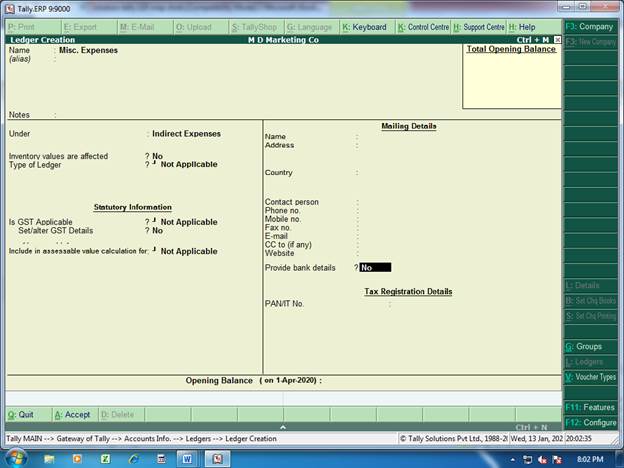

22 |

Misc. Expenses |

Indirect Expenses |

22 |

|

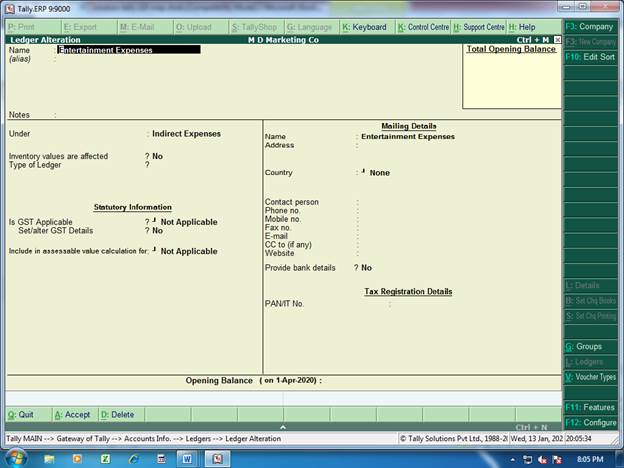

23 |

Entertainment Expenses |

Indirect Expenses |

23 |

|

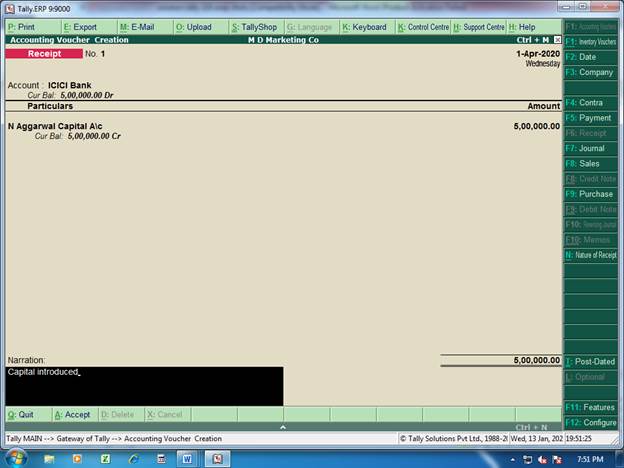

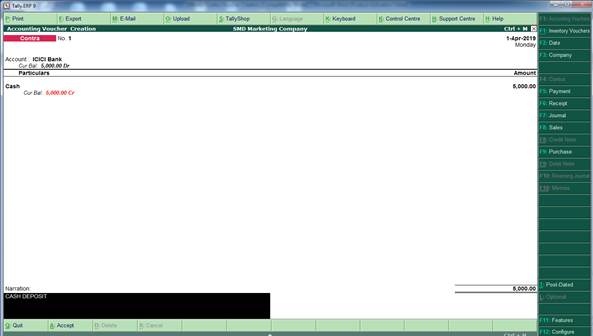

Entry.101 |

Mr. N. Aggarwal started business in the name of M\s M D Marketing Co. with Rs.5,00,000/- by cheque and deposited the same in ICICI Bank by opening a new account. |

||||||||||||||||||||||||||||

|

Sol:101 |

A) Two Accounts:

B) Accounting Journal Entry

ICICI Bank ………Dr 500000.00 N.Aggarwal Capital A\c……Cr 500000.00

C) Tally Voucher-Receipt (F6)

D) Tally Entry:

Account: ICICI Bank Particulars: N Aggarwal capital A\c (See Photo-24) |

||||||||||||||||||||||||||||

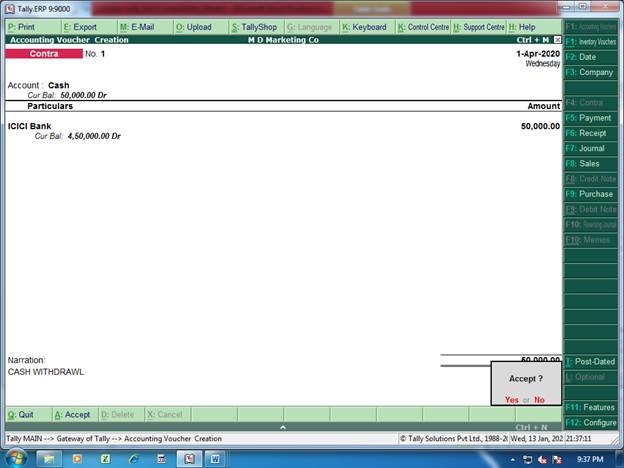

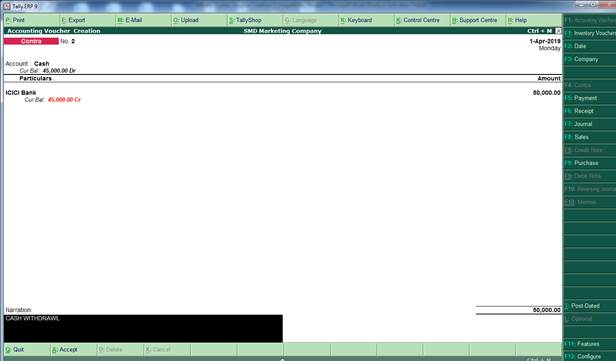

|

Entry.102 |

Mr. Aggarwal withdrew Rs.50,000/- from ICICI bank for office use. |

||||||||||||||||||||||||||||

|

Sol:102 |

A) Two Accounts:

B) Accounting Journal Entry

Cash A\c ………Dr 50000.00 ICICI Bank……Cr 50000.00

C) Tally Voucher-Contra (F4)

D) Tally Entry:

Account: ICICI Bank Particulars: N Aggarwal capital A\c (See Photo 25) |

||||||||||||||||||||||||||||

|

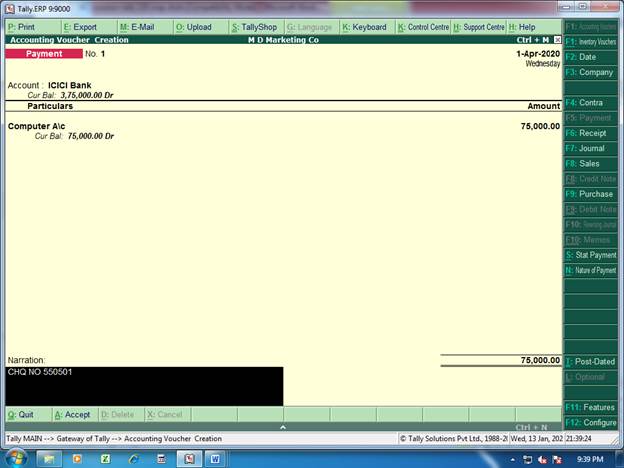

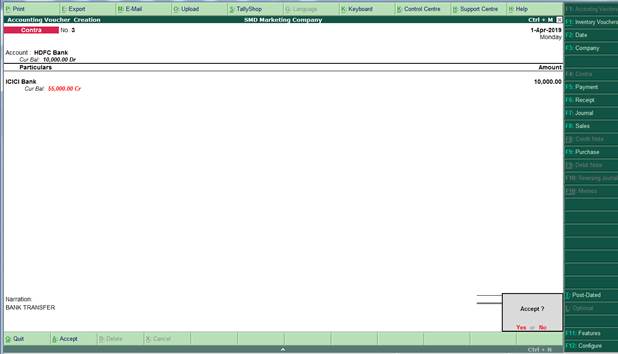

Entry.103 |

He purchased computer worth Rs.75000/- for office by paying a cheque no 550501. |

||||||||||||||||||||||||||||

|

Sol:103 |

A) Two Accounts:

B) Accounting Journal Entry

Computer A\c ………Dr 75000.00 ICICI Bank……Cr 75000.00

C) Tally Voucher-Payment (F5)

D) Tally Entry:

Account: ICICI Bank Particulars: Computer A\c (See Photo -26) |

||||||||||||||||||||||||||||

|

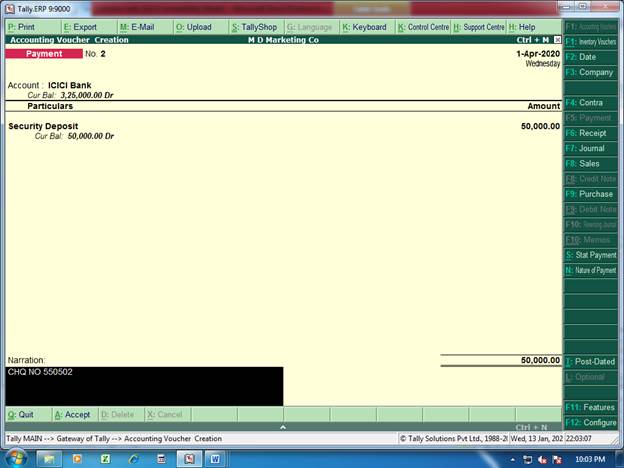

Entry.104 |

He deposited rental security for office Rs.50,000/- by cheque number 550502. |

||||||||||||||||||||||||||||

|

Sol:104 |

A) Two Accounts:

B) Accounting Journal Entry

Security Deposit A\c ………Dr 50,000.00 ICICI Bank……Cr 50,000.00

C) Tally Voucher-Payment (F5)

D) Tally Entry:

Account: ICICI Bank Particulars: Security Deposit A\c (See Photo 27) |

||||||||||||||||||||||||||||

|

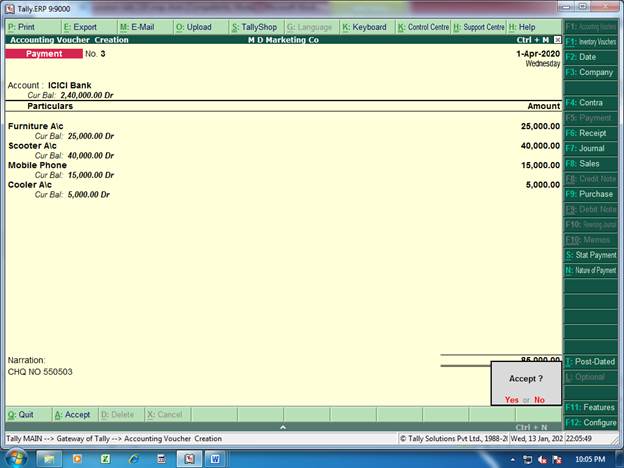

Entry.105 |

He issued a cheque number 550503 to purchase the following assets:Furniture Rs.25000/- , Scooter Rs.40000/-, Mobile Phone Rs.15000/- and Cooler Rs.5000/-. |

||||||||||||||||||||||||||||

|

Sol:105 |

A) Two Accounts:

Scooter A\c Mobile Phone A\c Cooler A\c

B) Accounting Journal Entry

Furniture A\c …….Dr 25000.00 Scooter A\c…………Dr 40000.00 Mobile Phone A\c.Dr 15000.00 Cooler A\c…………..Dr 5000.00 ICICI Bank………………..Cr 85000.00

C) Tally Voucher-Payment (F5)

D) Tally Entry:

Account: ICICI Bank Particulars: Furniture A\c …….Dr 25000.00 Scooter A\c…………Dr 40000.00 Mobile Phone A\c.Dr 15000.00 Cooler A\c…………..Dr 5000.00 (See Photo 28) |

||||||||||||||||||||||||||||

|

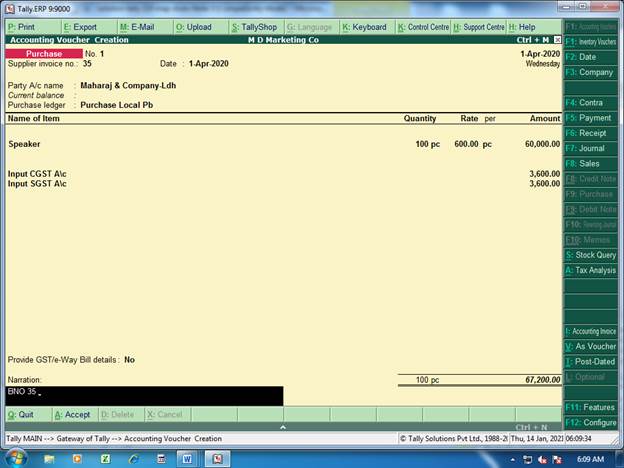

Entry.106 |

He purchased the following goods on credit from M\s Maharaj & Company, Ludhiana Punjab: Invoice no 35

|

||||||||||||||||||||||||||||

|

Sol:106 |

A) Two Accounts:

Input CGST A\c Input SGST A\c

B) Accounting Journal Entry

Purchase Local GST A\c….Dr 60000.00 Input CGST A\c……………….Dr 3600.00 Input SGST A\c……………….Dr 3600.00 Maharaj and Company…………..Cr 67200.00

C) Tally Voucher-Purchase (F9)

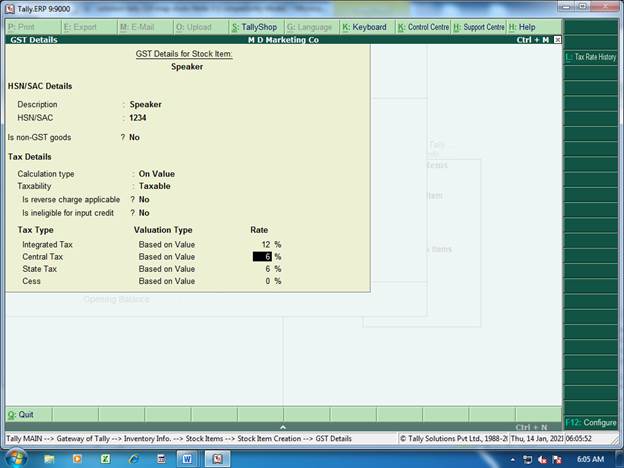

D) Unit of Measure: pc (Create By using I U C)-(See Photo-29) E) Stock Item: Speaker (Create By using I I C and GST Rate 12%) (See Photo-30 & 31)

F) Tally Entry: (See Photo-32)

Party Account Name : Maharaj & Company Name of Item: Speaker Qty: 100 Rate 600 Amount : Automatically Rs.60000/- Press two enter Input CGST: amount automatically Displayed as 3600/- Input SGST: amount automatically Displayed as 3600/-

|

||||||||||||||||||||||||||||

|

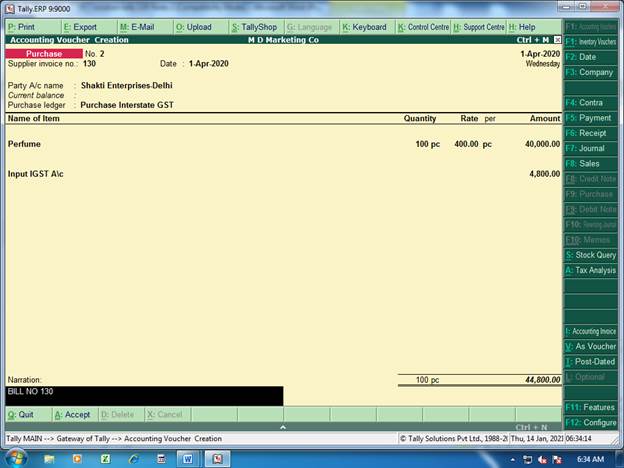

Entry.107 |

He purchased the following goods on credit from M\s Shakti Enterprirses., Delhi: Invoice No 130

|

||||||||||||||||||||||||||||

|

Sol:107 |

A) Two Accounts:

Input IGST A\c

B) Accounting Journal Entry

Purchase Interstate GST A\c….Dr 40000.00 Input IGST A\c……………….Dr 4800.00 Shakti Enterprises-Delhi…………..Cr 44800.00

C) Tally Voucher-Purchase (F9)

D) Stock Item: Perfume (Create By using I I C and GST Rate 12%) (See Photo-30 & 31)

E) Tally Entry: (See Photo-33)

Party Account Name : Maharaj & Company Name of Item: Perfume Qty: 100 Rate 400 Amount : Automatically Rs.40000/- Press two enter Input IGST: amount automatically Displayed as 4800/-

|

||||||||||||||||||||||||||||

|

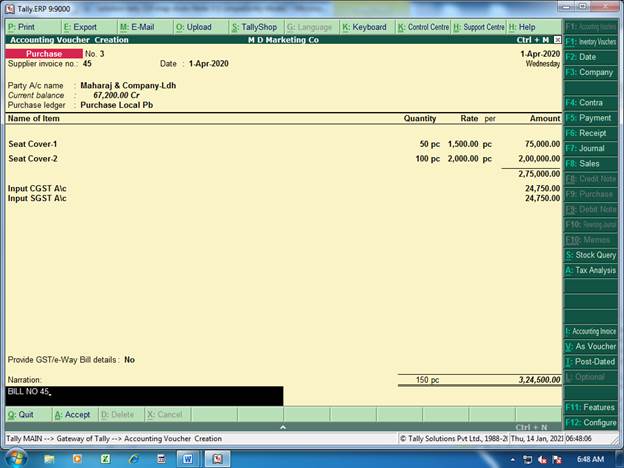

Entry.108 |

He purchased the following goods on credit from m\s Maharaj & Company, Ludhiana: invoice No 45

|

||||||||||||||||||||||||||||

|

Sol:108 |

A) Two Accounts:

Input CGST A\c Input SGST A\c

B) Accounting Journal Entry

Purchase Local GST A\c….Dr 275000.00 Input CGST A\c……………….Dr 24750.00 Input SGST A\c……………….Dr 24750.00 Maharaj and Company…………..Cr 324500.00

C) Tally Voucher-Purchase (F9)

E) Stock Item: Seat Cover-1 & Seat Cover-2 (Create By using I I C and GST Rate 18%) (See Photo-30 & 31)

D) Tally Entry: (See Photo-34)

Party Account Name : Maharaj & Company Name of Item: Seat Cover-1 Qty: 50 Rate 1500 Amount : Automatically Rs.75000/-

Name of Item: Seat Cover-2 Qty: 100 Rate 2000 Amount : Automatically Rs.200000/-

Press two enter Input CGST: amount automatically Displayed as 24500/- Input SGST: amount automatically Displayed as 24500/-

|

||||||||||||||||||||||||||||

|

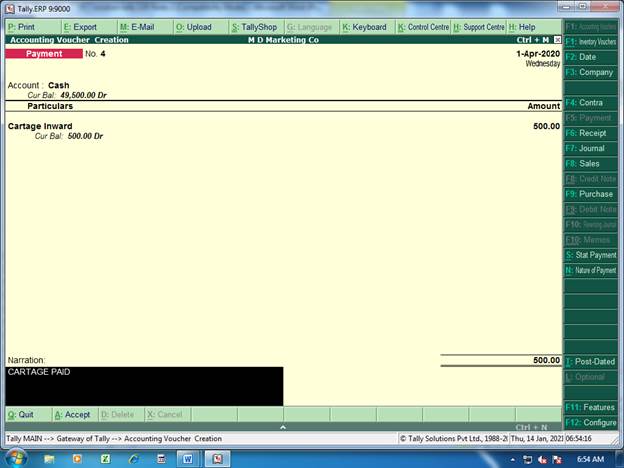

Entry.109 |

He paid cartage inward Rs.500/- in cash on purchase made. |

||||||||||||||||||||||||||||

|

Sol:109 |

A) Two Accounts:

B) Accounting Journal Entry

Cartage Inward A\c ………Dr 500.00 Cash……Cr 500.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -35)

Account: Cash Particulars: Cartage Inward A\c |

||||||||||||||||||||||||||||

|

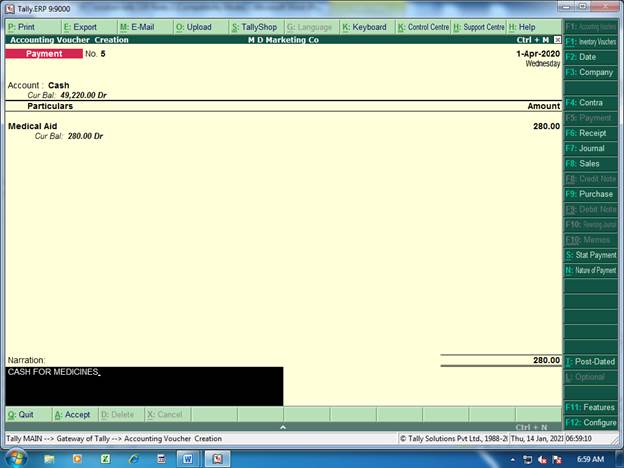

Entry.110 |

He paid cash Rs.280/- for medical aid to staff. |

||||||||||||||||||||||||||||

|

Sol:110 |

A) Two Accounts:

B) Accounting Journal Entry

Medical Aid A\c ………Dr 280.00 Cash……Cr 280.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -36)

Account: Cash Particulars: Medical Aid A\c |

||||||||||||||||||||||||||||

|

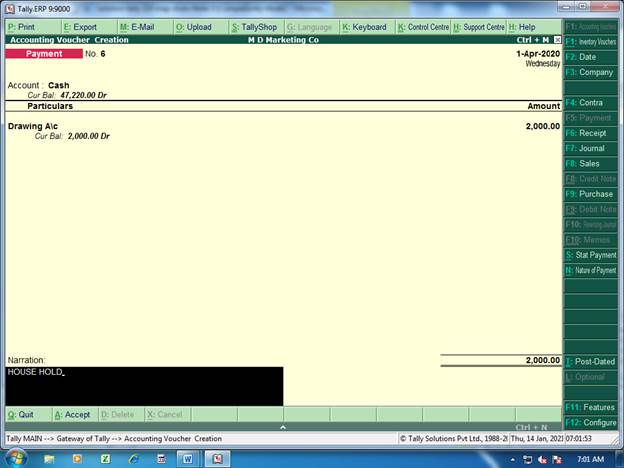

Entry.111 |

He take cash Rs.2000/- for personal use. |

||||||||||||||||||||||||||||

|

Sol:111 |

A) Two Accounts:

B) Accounting Journal Entry

Drawing A\c ………Dr 2000.00 Cash……Cr 2000.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -37)

Account: Cash Particulars: Drawing A\c |

||||||||||||||||||||||||||||

|

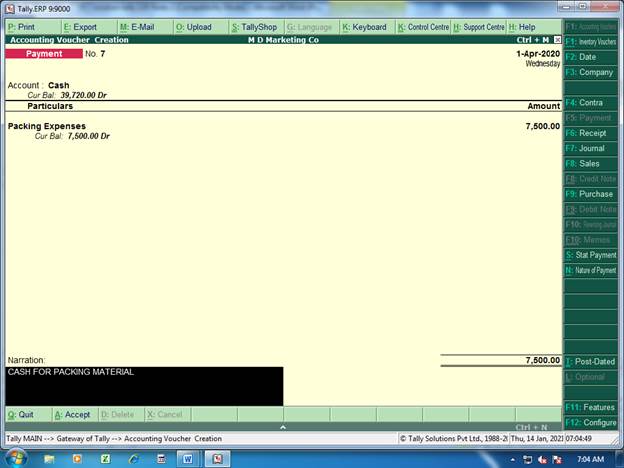

Entry.112 |

He paid Rs.7500/- in cash for packing material. |

||||||||||||||||||||||||||||

|

Sol:112 |

A) Two Accounts:

B) Accounting Journal Entry

Packing Expenses A\c ………Dr 7500.00 Cash……Cr 7500.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -38) Account: Cash Particulars: Packing Expenses A\c

|

||||||||||||||||||||||||||||

|

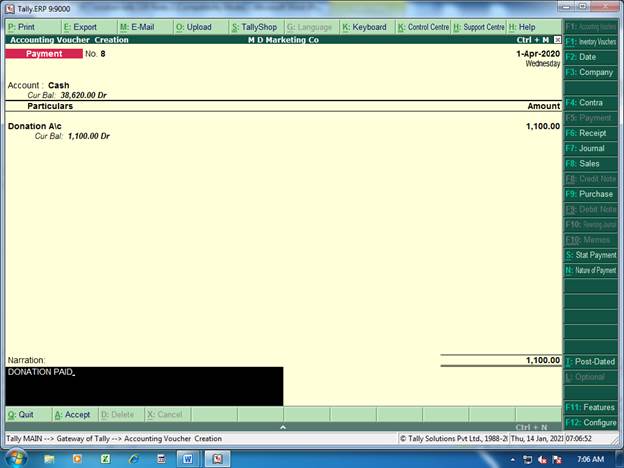

Entry.113 |

He paid Rs.1100/- as donation to a charitable trust. |

||||||||||||||||||||||||||||

|

Sol:113 |

A) Two Accounts:

B) Accounting Journal Entry

Donation A\c ………Dr 1100.00 Cash……Cr 1100.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -39) Account: Cash Particulars: Donation A\c |

||||||||||||||||||||||||||||

|

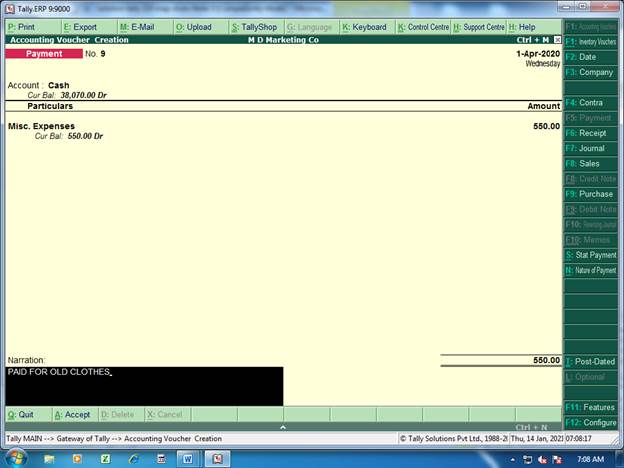

Entry.114 |

He paid Rs.550/- in cash for old clothes for dusting. |

||||||||||||||||||||||||||||

|

Sol:114 |

A) Two Accounts:

B) Accounting Journal Entry

Misc. Expenses A\c ………Dr 550.00 Cash……Cr 550.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -40) Account: Cash Particulars: Misc. Expenses A\c |

||||||||||||||||||||||||||||

|

Entry.115 |

He paid Rs.70/- in cash for tea to customers. |

||||||||||||||||||||||||||||

|

Sol:115 |

A) Two Accounts:

B) Accounting Journal Entry

Entertainment Expenses A\c ………Dr 70.00 Cash……Cr 70.00

C) Tally Voucher-Payment (F5)

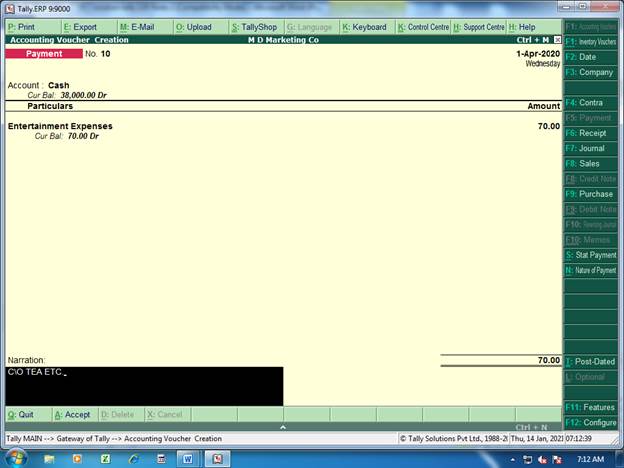

D) Tally Entry: (See Photo -41) Account: Cash Particulars: Entertainment Expenses A\c |

||||||||||||||||||||||||||||

|

Entry.116 |

He paid Rs.700/- in cash for sweeper & watchman. |

||||||||||||||||||||||||||||

|

Sol:116 |

A) Two Accounts:

B) Accounting Journal Entry

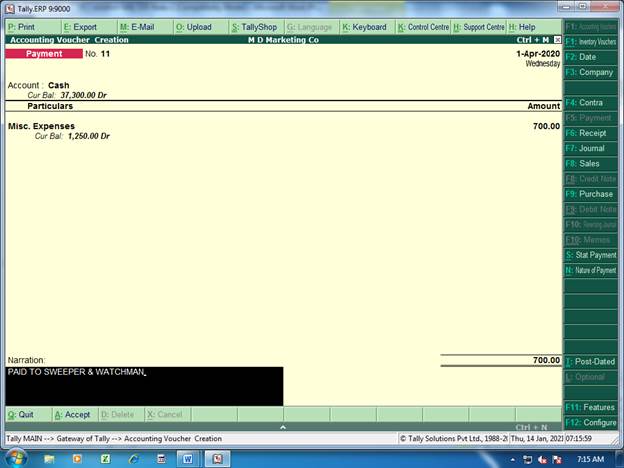

Misc. Expenses A\c ………Dr 700.00 Cash……Cr 700.00

C) Tally Voucher-Payment (F5)

D) Tally Entry: (See Photo -42) Account: Cash Particulars: Misc. Expenses A\c |

|

N. Aggarwal Capital A\c (Photo-1)

|

|

ICICI Bank (Photo-2)

|

|

Cash (already in tally)-Photo-3

|

|

Computer A\c-(Photo-4)

|

|

Security Deposit-(Photo-5)

|

|

Furniture A\c-(Photo-6)

|

|

Scooter A\c-(Photo-7)

|

|

Mobile Phone-(Phone-8)

|

|

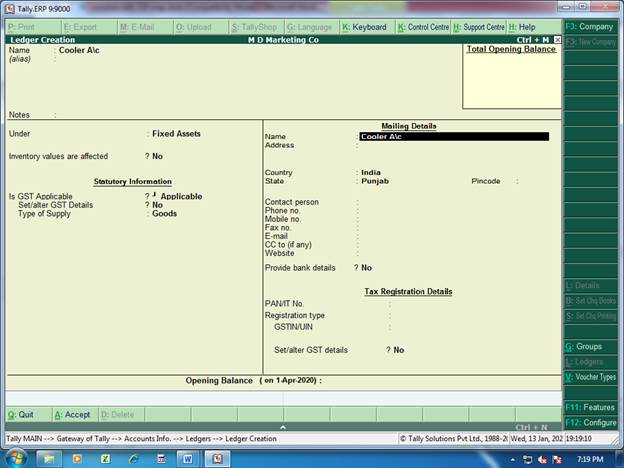

Cooler A\c-(Photo-9)

|

|

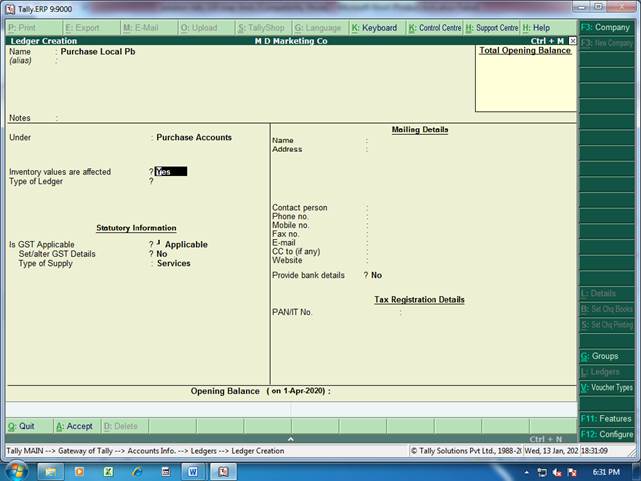

Purchase Local Pb (Photo 10)

|

|

|

|

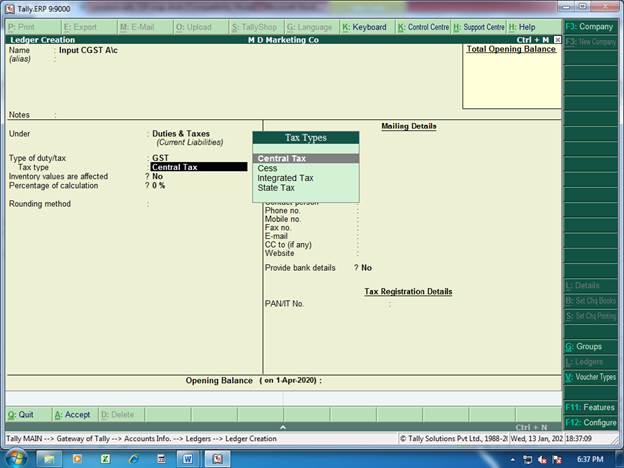

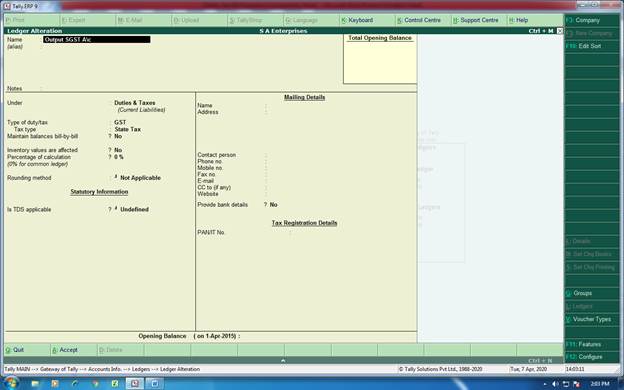

Input CGST A\c (Photo-11)

|

|

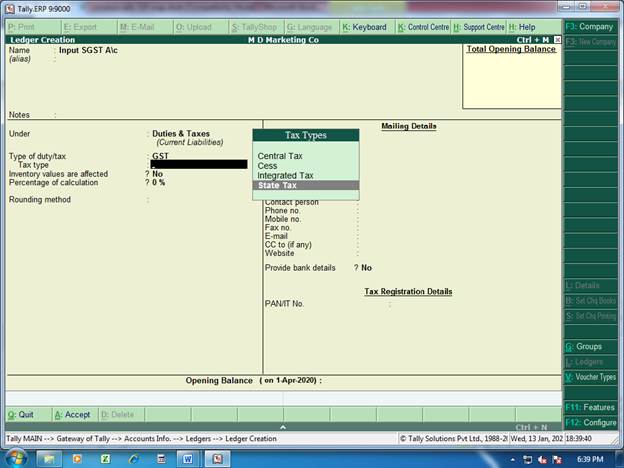

Input SGST A\c ( Photo-12)

|

|

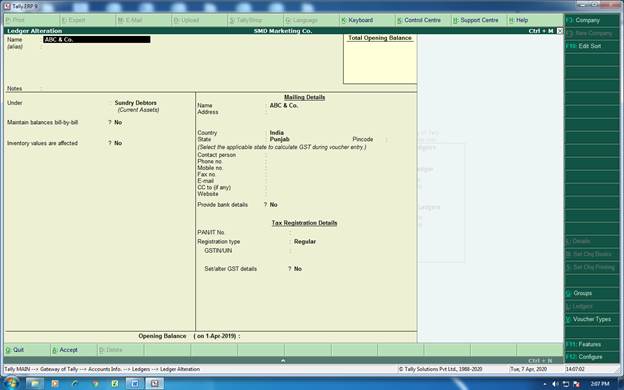

Maharaj & Comapnay-Ldh (Photo-13)

|

|

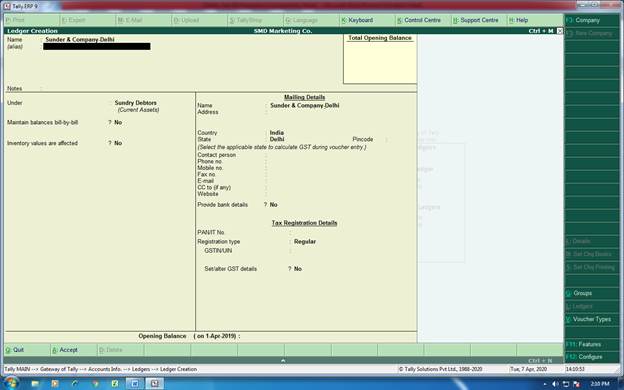

Shakti Enterprises-Delhi (Photo-14)

|

|

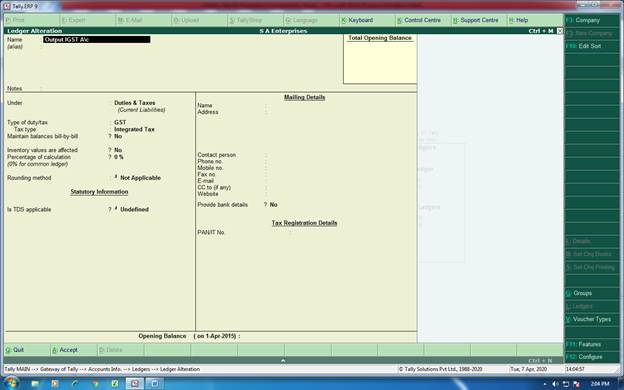

Purchase Interstate GST (Photo-15)

|

|

Input IGST (Photo-16)

|

|

Cartage Inward-Photo-17

|

|

Medical Aid-Photo-18

|

|

Drawing A\c-Photo-19

|

|

Packing Expenes-Photo-20

|

|

Donation A\c-Photo-21

|

|

Misc. Expenses-Photo-22

|

|

Entertainment Expenses-Photo-23

|

|

Entry-101-Photo-24

|

|

Entry 102-Photo-25

|

|

Entry-103-Photo-26

|

|

Entry-104-Photo-27

|

|

Entry-105-Photo-28

|

|

Entry-106 (a)-Photo-29

|

|

Entry-106 (b)-Photo-30

|

|

Entry-106 (c)-Photo-31

|

|

Entry-106 (d)-Photo-32

|

|

Entry-107-Photo-33

|

|

Entry-108-Photo-34

|

|

Entry-109-Photo-35

|

|

Entry-110-Photo-36

|

|

Entry-111-Photo-37

|

|

Entry-112-Photo-38

|

|

Entry-113-Photo-39

|

|

Entry-114-Photo-40

|

|

Entry-115-Photo-41

|

|

Entry-116-Photo-42

|